Administration Guide

A guide for your Senomix administration application for Windows, Mac and other desktop systems.

Looking for the basics? We've provided a Getting Started Guide which shows you

how to create user accounts and projects for your system.

For step-by-step instructions, visit your "How Do I..?" page.

The desktop web application for Senomix Timesheets can be used with your Windows or Mac desktop and laptop computers through any modern web browser (so, updated Google Chrome, Firefox or Internet Explorer 10 and later).

For simplicity in this guide, all screens will be shown using the Google Chrome web browser, which is the web browser we recommend for the best performance while working with your Senomix account. If you do not yet have Google Chrome, you can download that browser for your own computer at no cost from Google Chrome's web site.

System screens will be automatically sized to fit the available space on your computer monitor, with a scrollbar appearing on your browser if there is not enough space available to display all information.

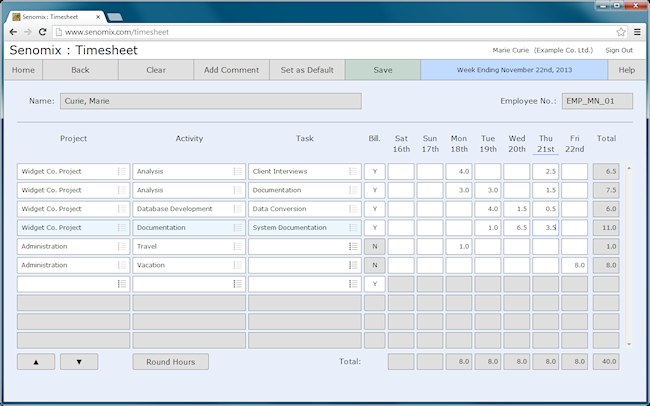

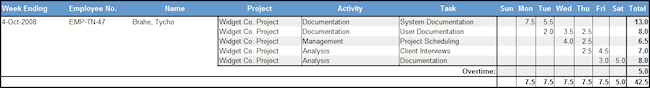

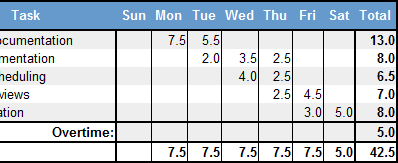

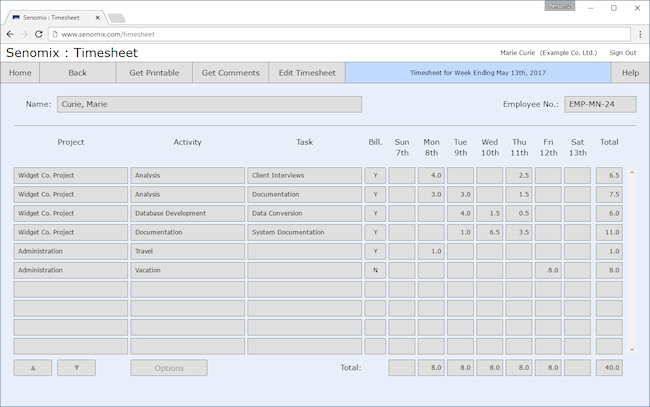

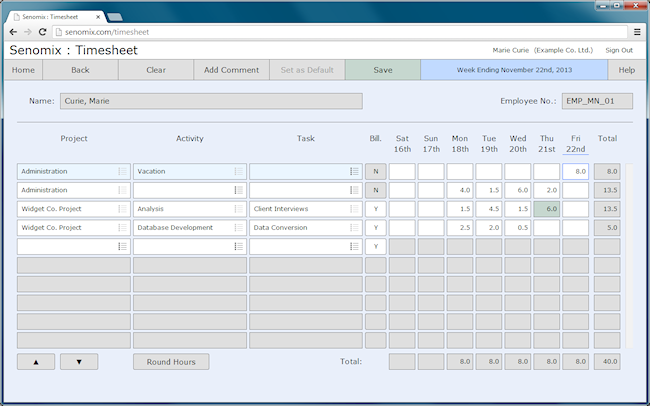

For example, a timesheet would appear as follows on a laptop computer monitor with 1280x800 pixels resolution:

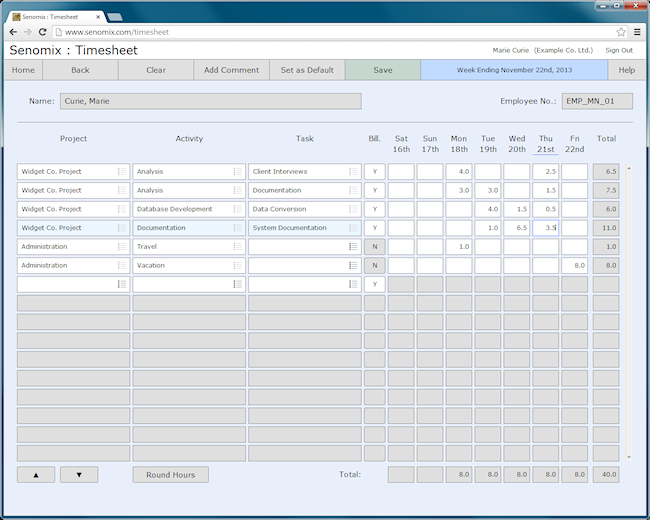

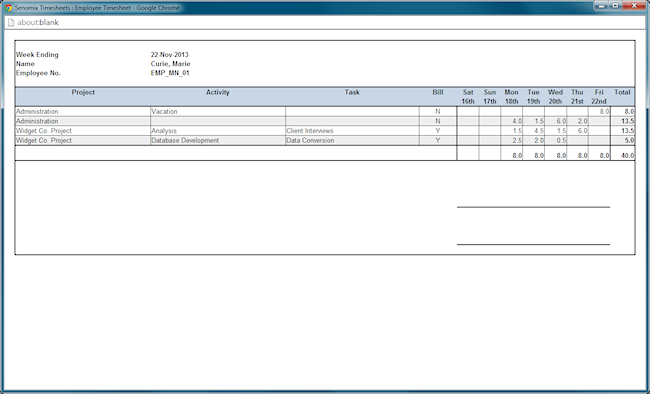

And would appear as follows for a desktop computer monitor of 1280x1024 pixels resolution:

As shown, if space is available, additional lines of information will be displayed to fit the screen space available to you. Your computer's screen size does not limit the amount of information you can enter in your Senomix timesheet or expense claim records, and additional lines can be scrolled to off-screen if your computer monitor is too small to display all information at once.

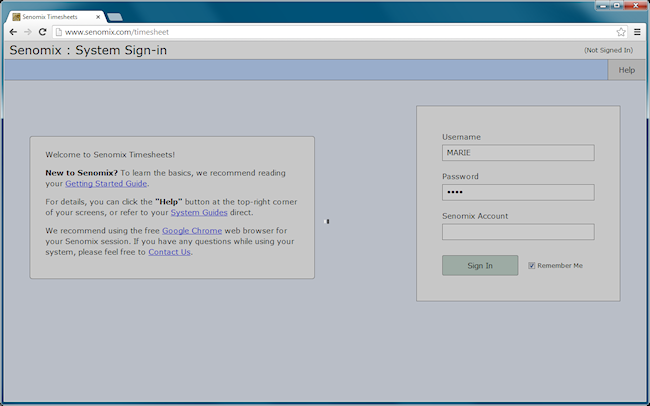

Whenever Senomix Timesheets needs for you to wait while it communicates with your server, your screen will display a grey shade with an animated wait spinner displayed in the middle, as with this system login:

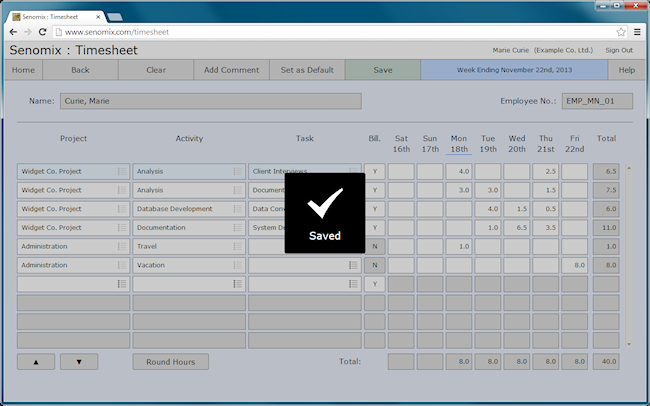

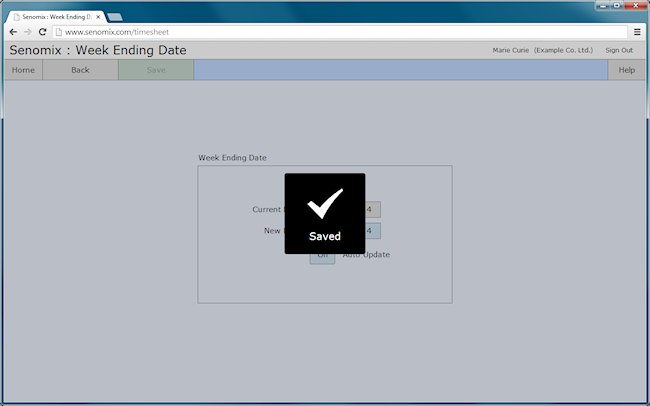

Similarly, when your application has completed a save action for your timesheet or expense claim information, it will inform you of the save success with a checkmark information message displayed in the center of your screen:

To dismiss a confirmation checkmark, just click anywhere outside the checkmark box on your computer screen.

To provide an efficient workflow, most of your administration screens will not display a 'saved' checkmark when saving your project, activity, task or other administrative information. After data has been saved on your system, your green toolbar 'Save' button will return to a disabled state to indicate that no changes are waiting to be saved.

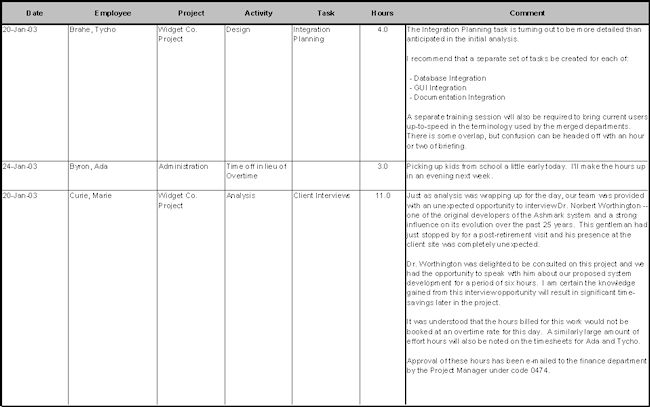

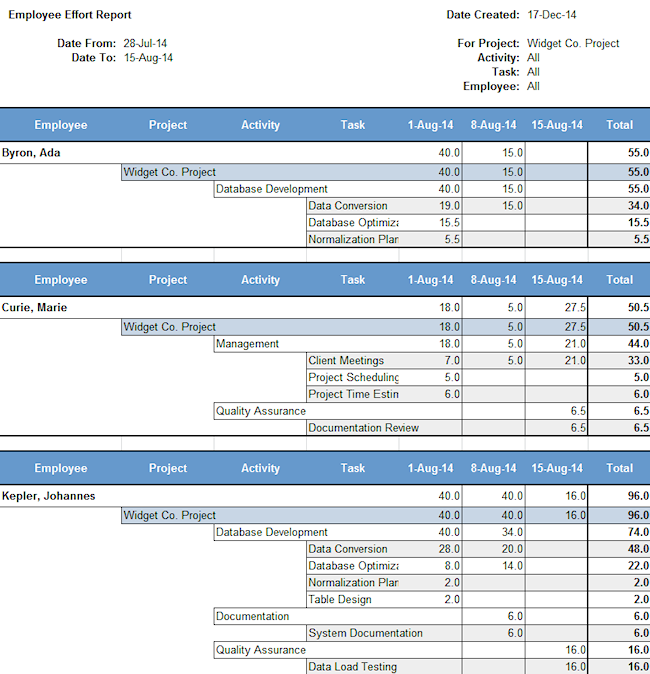

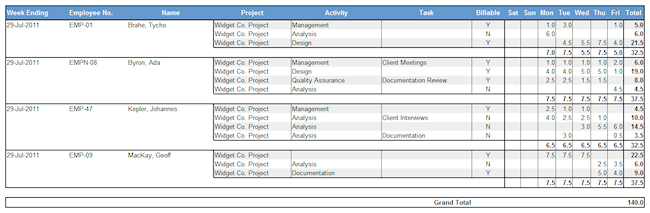

Senomix billing codes can be adjusted to fit the level of precision required for time tracking of each employee. Depending upon the responsibilities of an individual working on a project, this can result in time being tracked on a task-by-task basis or simply by project if a particular activity or task cannot be identified for a person's work.

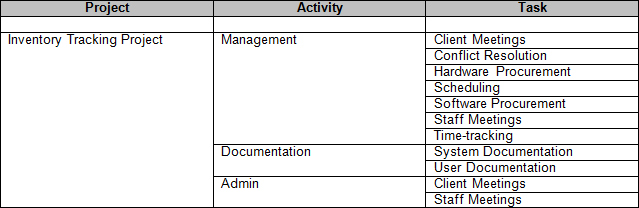

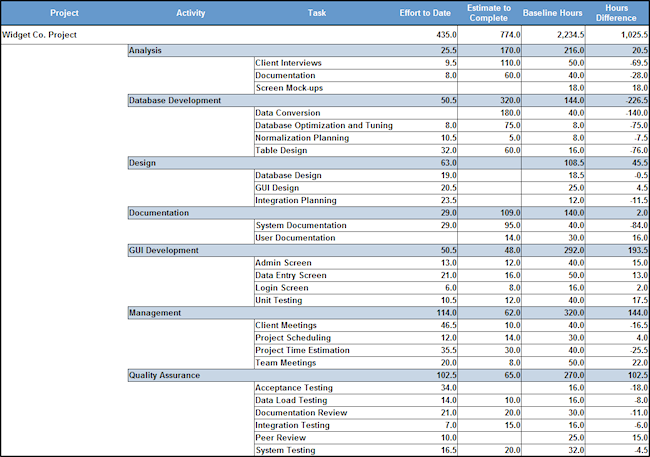

Billing codes can accommodate both unchanging projects (which use the same billing codes year-after-year) and development and system maintenance environments in which project requirements must be quickly addressed as they emerge. Considering an example project for the creation of an inventory tracking system, an initial set of billing codes might be created as follows:

The activities and tasks of Senomix projects can be managed through one or more project template records. A project template is a special type of project whose activities and tasks can be assigned to one or more different projects but is not referenced directly as a project itself.

When a project template's activity and task records are changed, the changes made to that template will apply immediately to all projects assigned to use it. This provides you with a centralized way to manage the activity and task options for dozens, hundreds or thousands of projects at once without requiring numerous edits to each project affected by a billing code change.

For example, if the inventory tracking project described above had been created as a project template and assigned to a few dozen projects, the changes made to the Development - Data Export task would be applied to all projects at once without any other changes needed.

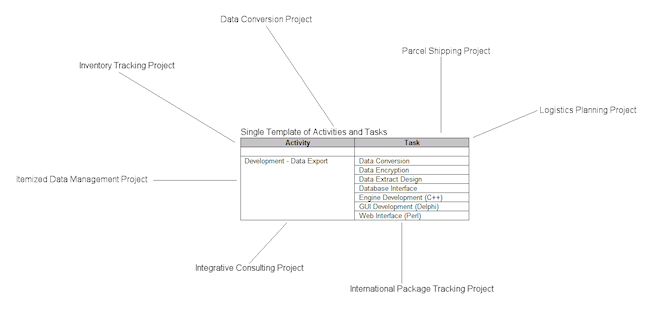

Showing this in a diagram, project templates allow multiple projects to 'point to' the same, single set of activities and tasks:

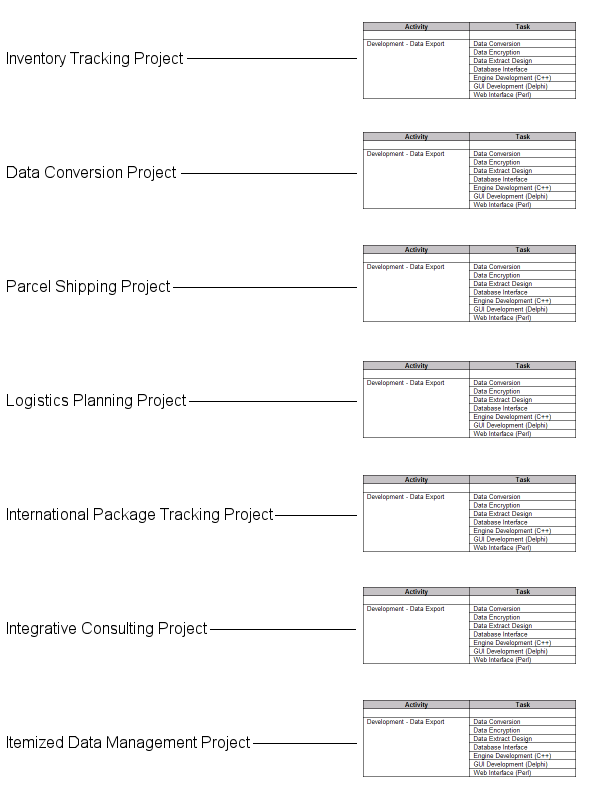

Whereas a set of standard projects (often created through a project copy action) will each have their own set of individual activity and task records:

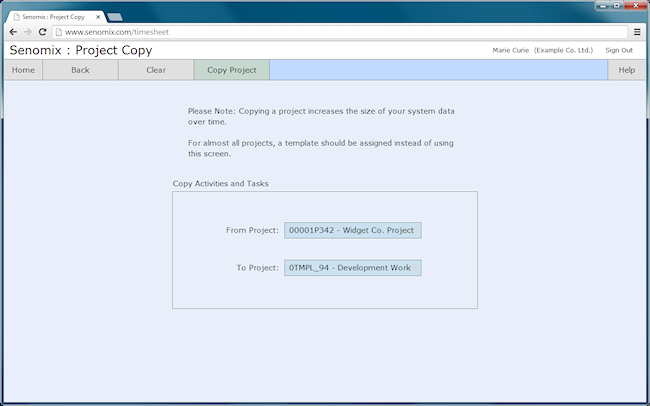

Although the activities and tasks are still named identically after performing a project copy, each set of billing codes are created and edited independently (which can make the management of your Senomix projects more difficult over time). To avoid this, project templates should be used in place of 'project copy' whenever possible.

Project templates should be used for all projects in your office which have a similar structure.

A 'project copy' action should only be performed to help set up a new project template, or to create custom activity and task lists if your office performs a few large-scale projects each year. For simplicity, long-term projects which will only be referenced once in your system (such as internal records for recording in-house administration or vacation time) should be created without using a project template. All other work should reference your office's own set of project templates.

To sign in to your Senomix administration application, you will connect with your email address username and password along with your office's account name.

Your application sign-in screen can be reached by opening the web page:

With that screen providing a form in which you can enter your sign-in details:

Once your sign-in information has been entered, Senomix Timesheets will remember your email username, your office's account name, and your last selected application and automatically set those values the next time you visit your sign-in page. If you would prefer that information not be remembered for you, tick the "Remember Me" checkbox 'off' before signing in:

The email address and password to enter for your sign-in will be those entered for you by your Senomix administrative user (or, for your first sign-in, the email and password you provided when creating your hosting plan account).

Your office's Senomix Account will be your "Company Name" (as entered when signing up for your Senomix account) with all space characters and punctuation removed. For example, if your "Company Name" was provided as "Example Co. Ltd", the Senomix Account name to enter for your sign-in would be "ExampleCoLtd" (you can also enter your account name in all lower-case letters, like "examplecoltd").

An email with your Senomix account name and other information will have been sent to your office when first registering. If you have forgotten or misplaced your office's Senomix account details, please do Contact Us for assistance.

The Senomix application to which you will be connecting can be selected from the three options provided just above your sign-in button:

Options for your time and expense entry, reports and administration applications are provided, with your selected application highlighted in blue. To sign in to your administration application, the last button will be selected, as shown above.

After entering your email username, password, company account name, and selecting your Senomix application, click the green 'Sign In' button to connect:

You will then be signed in to your Senomix account and brought to your Main Menu screen:

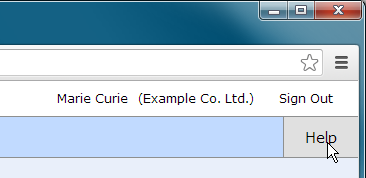

After signing in, your own name and company name can be seen at the top-right corner of every system screen:

The "Help" button at that top-right corner can be clicked at any time to provide help for the screen you are currently viewing:

And the "Sign Out" link can be used to disconnect your Senomix session:

If you have any questions about signing in to your Senomix account, please contact us at support@senomix.com. We'll be happy to help!

Once you have signed in to Senomix Timesheets, you will be brought to your Main Menu screen. To move from your Main Menu and between system screens, click the appropriate menu or toolbar button to make your selection.

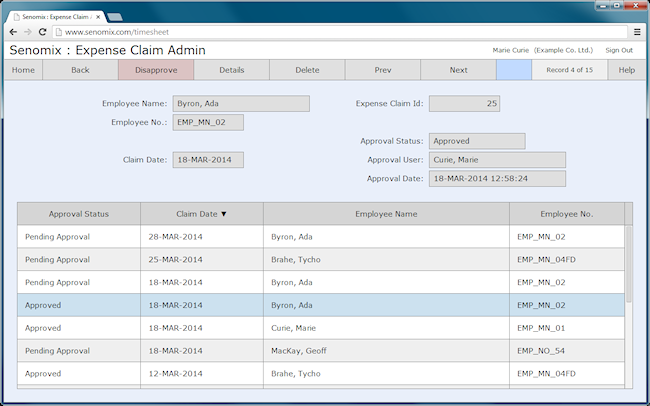

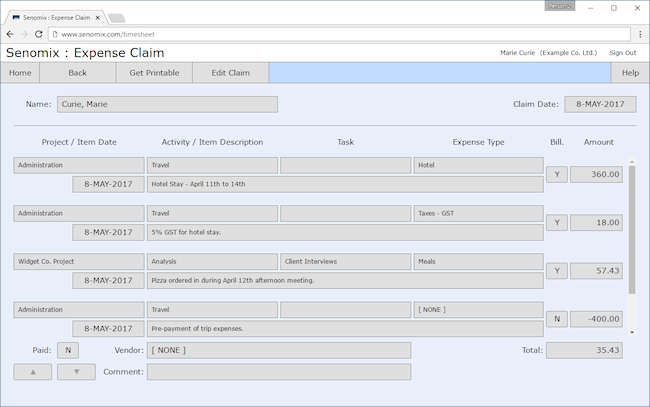

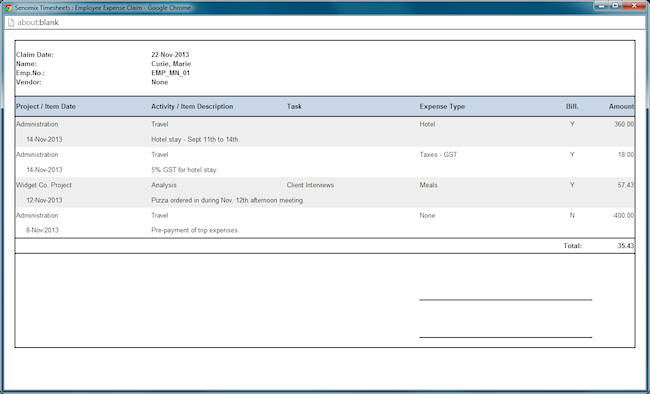

A toolbar is provided at the top of every system screen, such as this toolbar shown at the top of your Timesheet Entry screen:

Using that toolbar, you can move back one screen from your current location by clicking the "Back" button:

Or you can click the "Home" button to jump directly to your Main Menu screen:

To get help for the screen you are currently using, click the "Help" button:

To sign out and exit Senomix Timesheets you can click the Sign Out button at the bottom-right corner of your Main Menu screen, or click the top-right corner "Sign Out" link at any time.

After you have signed in to your account, you will be brought to your Administration application's Main Menu:

All functionality for your administration application can be reached through this screen, with the available options to be found in the button bar at the screen's right-hand side. These buttons have the following functionality:

User Admin

Opens your User Administration screen, allowing you to add or edit user accounts.

Project Admin

Opens your Project Administration screen, allowing you to add or edit projects.

Create Report

Opens your Create Report screen, allowing you to create system reports.

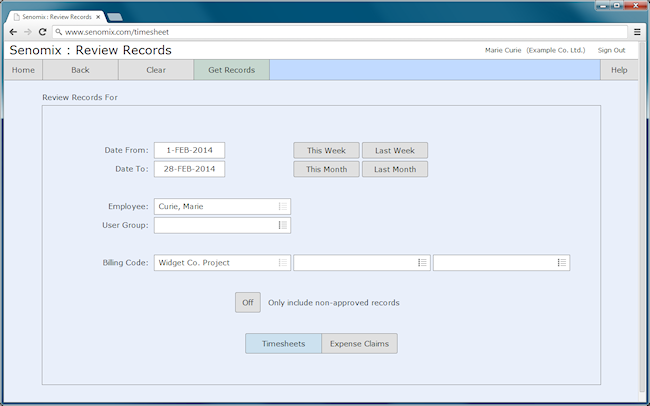

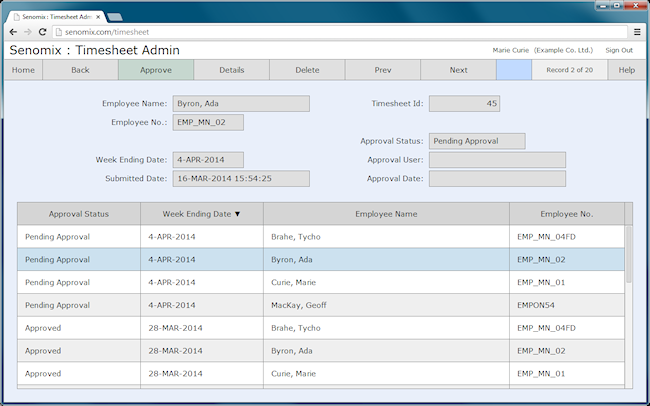

Review Records

Opens your Review Records screen, from which you can retrieve timesheet and expense claim records for review, approval or editing.

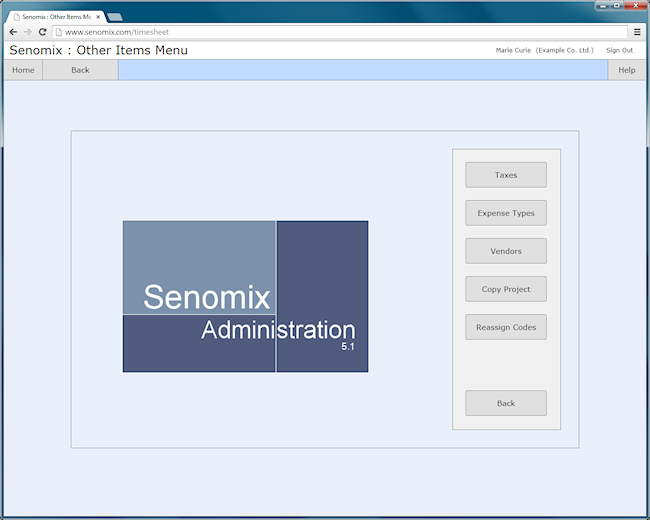

Configuration

Opens your Configuration Sub-Menu screen, from which you can define project and user groups for reporting, adjust system settings, or open another menu to adjust your system's taxes, expense types and vendors, as well as copy a project's contents or reassign billing codes applied to a particular project.

About

Opens the About screen for your application, providing information about your system's version and registration.

Sign Out

Signs you out of your Senomix Administration session.

Help

Opens a new web page displaying help for your current screen.

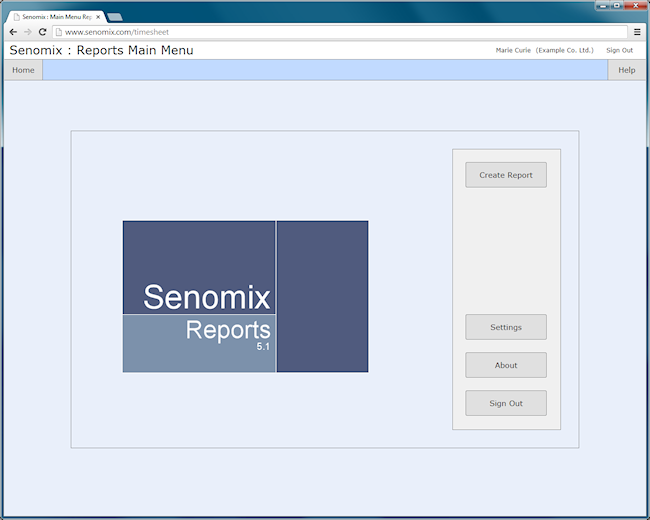

If you are connecting to the reports application (either for administrative, non-financial or personal reports) you will be brought to your Reports application's Main Menu:

The reports application provides a subset of the functionality provided in the full administration application, with the available options provided in the button bar at the screen's right-hand side. These buttons have the following functionality:

Create Report

Opens your Create Report screen, allowing you to create time and expense reports.

Settings

Opens your system Settings screen, allowing to you set your application preferences.

About

Opens the About screen for your application, providing information about your system's version and registration.

Sign Out

Signs you out of your Senomix Reports session.

Help

Opens a new web page displaying help for your current screen.

Your user administration screen allows you to create and modify Senomix user accounts for your staff. Projects can be assigned to user accounts to restrict options for time entry, and users can be assigned to an account to place those individuals in a manager's scope of responsibility for timesheet approval and reports access.

This screen is reached from your main menu.

The buttons and fields provided on this screen are as follows:

Home / Back

Exits the screen and returns you to your main menu.

New

Clears the screen to prepare it for entering a new user.

Save

Saves to your database any changes made to the selected user.

Delete

Deletes the selected user from your database.

Prev

Selects the previous user displayed in the screen's table window.

Next

Selects the next user displayed in the screen's table window.

Help

Opens a new web page displaying help for your current screen.

Employee No.

The employee number provided for the selected user account. No two users can have the same employee number assigned.

First Name

The first name of the person assigned to the selected user account.

Last Name

The last name of the person assigned to the selected user account.

Phone

The phone number of the person assigned to the selected user account.

Email Address

The email address username of the person assigned to the selected user account. Used for the user account's system sign-in.

Username

This field has been removed as of Senomix v5.2. System sign-in is now handled with a user's email address.

If you are using a legacy self-installed version of Senomix Timesheets, please switch to use of email address for system sign-in.

Password

The password the selected user account will use for system sign-in.

Payroll Item

The QuickBooks Payroll Item to use in exports to your office's accounting software. If you are not using the QuickBooks Online Payroll module, please leave this item blank.

User Access

The system access rights granted to the selected user account.

Available options for selection are:

Full Timesheet Access:

Provides the user account with access to all functionality in the timesheet entry application.

Stopwatch Access Only:

Limits the user account to only using the stopwatch to record their time. Access to the timesheet entry and listing screens, as well as all expense claim functionality, is blocked for these users.

A start and stop timestamp will also be automatically set in the user's stopwatch comments, with those comments blocked from the user's direct edit. The start/stop timestamp for system users can be viewed by a manager or administrator by creating a timesheet comments report.

No Time Entry Allowed:

Blocks the user from recording any time or expenses for their account. Non-time entering users are not counted towards your office's user limit.

If you have system users in your office who will only perform administrative tasks such as generating reports, approving timesheets or otherwise managing your system without recording time themselves, you can set their user account to this access right and free up their license slot for use by another of your time recording employees.

Default Rate

The default billing rate to be used when generating invoices for time recorded by the selected user account. If an employee is billed at the same billing rate for all project work, that rate should be entered here.

If an employee is charged out at a different rate for different projects, this value should be left blank, with rates specified in your project or billing rate administration screens instead.

Hours Per Week

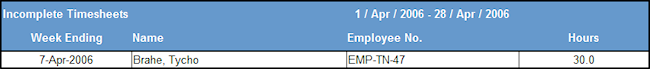

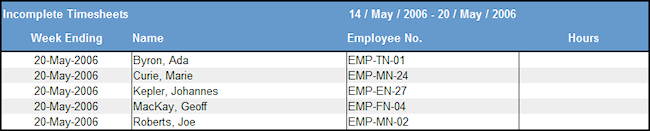

The number of hours which the selected user account is expected to have recorded in their timesheet for a typical work week. Used to determine whether a person's timesheet is incomplete for purposes of sending automated e-mail reminders, identifying overtime in a spreadsheet report, or generating an incomplete timesheets report.

If this field is left blank, the Hours in Week value entered in your application settings screen will be used to determine the user's expected work week. An hours value should only be entered in this field if an employee has a non-standard work week. For example, an employee working part time and expected to record only 16 hours per week would have "16" entered in this field.

User Id

Displays the system-assigned id of the selected user.

Active

A checkbox which indicates whether or not the displayed user account is allowed to connect to your Senomix system. If a user's system access needs to be temporarily suspended, but their account will be reactivated at some point in the future, this checkbox can be used to handle that temporary suspension of system access.

A user account which has been set to a temporarily inactive state will still count against your office's recorded quantity of system users. To permanently inactive a user to remove them from your account total while still keeping all timesheets and expense claims for reference, you will want to set that user to be historic (as described below).

Administrator

A checkbox which indicates whether or not the displayed user account has access rights to your administration application.

A user with administrative rights will automatically have full access to all system reports (both through your administration and reports applications), and so reports access for an administrative user will be fixed at "Full Reports Access".

Reports Access

The reports access rights granted to the selected user account. User accounts with administrative rights are automatically granted full reports access, with the default for new user accounts being no access to system reports.

Non-administrative users with an assigned level of reports access can sign in to their reports application through the system sign-in screen.

Available options for selection are:

Full Reports Access:

Provides the user account with access to all system reports. This is the same level of reports access which an administrative user has available through their administration application.

Non-Financial Reports Only

Provides the user account with access to all system reports, with the exception of those provided under the "Financial" and "Data Export" panels of the report creation screen.

Personal Reports Only

Provides the user account with access to non-financial system reports, restricted to the user's own recorded information (the data of other users is not available to Personal Reports users).

No Reports Access

Blocks the user account from all system reports. Sign-in to the reports application is not allowed for these user accounts.

For Full and Non-Financial reports access, if a user account has user records assigned to them (through the "Assigned Users" button, described below) the user account will only be provided with reports access to the data of system users noted as being in their scope of responsibility. If no users are assigned to a user account, all recorded data will be available for their reports. Similarly, a user account with projects assigned to them will have their report data limited only to those projects to which they have been provided access.

An administrative user will always have access to all project and user account data for their reports, regardless of project assignment or employees who may be assigned to them for purposes of timesheet approval.

Assigned Projects

Opens the assigned projects screen, displaying the project assignments for the selected user.

A user account with projects assigned to them will have their timesheet and expense claim entry options limited only to the projects to which they have been assigned. If the user account has been provided with reports access, their reports will also be limited to their assigned projects.

Assigned Users

Opens the assigned users screen, displaying the user assignments for the selected user.

A user account with user records assigned to them is considered to have those system users in their scope of responsibility and so can approve timesheets created by those users. If the user account has full or non-financial reports access, they will also be able to create reports for data entered by those users set in their scope of responsibility.

Time Estimates

Opens the time estimates screen for the selected user, displaying (and allowing edit of) all time estimates entered by that employee for their planned work.

Billing Rates

Opens the billing rate administration screen, displaying all billing rates related to the selected user.

Create Timesheet

Opens the create timesheet screen, allowing a blank past or future timesheet to be created for the selected user.

If a timesheet more than ten weeks in the past or future needs to be created for a system user, that record can be created through this screen. For timesheets required within ten weeks of the current date, the off-week filing screen provided in the user's own time and expense entry application can be used to create missed past or pre-filed future timesheets.

Create Expense Claim

Opens a new expense claim for the selected user, allowing an administrator to enter expense claim data for the employee.

Expense claims can also be directly entered by a user through the expense claim entry screen provided in their time and expense entry application.

Clear Account 2FA

Clears two-factor authentication for the selected user.

If a user has lost their authenticator app entry for Senomix Timesheets, clearing 2FA will allow them to sign in.

(Please note: 2FA is only available for hosted Senomix plans)

Send Welcome Email

Sends an invitation message to the email address set for the currently selected user. This provides the employee with their connection information (with the exception of their password, which is not safe to send via email) and a link to their sign-in page.

Set Historic

Sets the displayed user to have a historic state (as described below). Setting a user to be historic permanently inactivates the user account and removes them from your system's registered user count while keeping all of their timesheets and expense claims for reference.

If a user account has already been set to a historic state, this button will be shaded red and have the label "Historic".

Showing All Users / Showing Only Active

Toggles the display of user records to only show user accounts which are active, or to show both active and inactive users.

To display all users which are active, inactive or set to a historic state, toggle this button to read "Showing All Users".

The table window in your user administration screen can be set to display records in order by last name, first name or employee number by clicking the corresponding table header.

A user record cannot be deleted if it is referenced in your system in timesheets or expense claims (either with that user account having entered timesheets or expense claims themselves, or having approved records for others). If a user account is associated with your system's timesheet or expense claim information, all timesheets and claims associated with that individual must first be deleted before that user can be removed.

Instead of deleting a user record, it is recommended that the user be set to a historic status instead. Setting a user to be historic permanently inactivates their account and frees up their license space in your system (so you can add another user in their place) while keeping all of their entered timesheet and expense claim information. Once a user has been set as historic, no further timesheets or expense claims can be created for that individual, and all of their existing records will be permanently blocked from edit.

Only users who have permanently left your organization should be made historic. Once a user has been made historic, the record cannot be reverted to a non-historic state through your administration application. However, Senomix Support can change a historic user's status for you if you would like to reverse that account's permanent inactivation and return them to active use. To reverse a historic user's status, please contact Senomix Support for assistance at support@senomix.com.

To set a system user to be historic, select their record and click the "Set Historic" button. Once that button has been clicked, a confirmation message will be displayed:

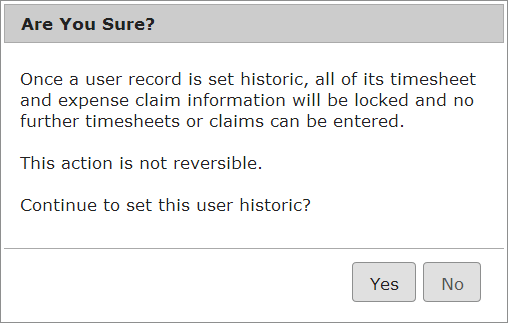

Clicking yes on that confirmation will display a secondary confirmation message, which reminds you that setting a record to be historic is not a reversible action:

After clicking yes on that secondary confirmation message, the displayed user record will be set as historic, with all of their timesheet and expense claim information locked from edit. The user administration screen will also be made non-editable for that user's account, with the set historic button changing to an alert shade of red to indicate the record's historic state.

For example, selecting the user Tycho Brahe from the user administration screen shown above and setting the account to be historic will display the following:

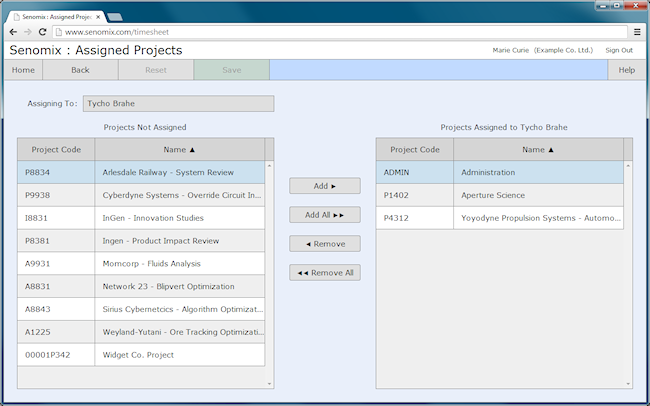

Your assigned projects screen allows you to specify the projects to which an employee will be limited for their time and expense entry. If no projects are assigned to an employee, they will be able to reference any active projects in their timesheets or expense claims.

If an employee's user account has been granted reports access, assigning projects to that employee will also limit them to creating reports only for those projects to which they have been assigned. An employee with reports access will be able to reference any project in their reports if they have not had specific projects assigned to them.

An administrative user signed in to their administration application will always be able to access all projects for their reports. Project assignment only limits access for timesheets and expense claims in the time and expense entry application, or report creation through the reports application.

If no projects are assigned to an employee's user account, and that employee's user account has been granted reports access, that person will be able to create reports for all system projects by default. Adding specific projects to a managerial employee's assigned projects will ensure that only information for those projects will be available through their reports application.

This screen is reached from your user administration screen.

The buttons and fields provided on this screen are as follows:

Home

Exits the screen and returns you to your main menu.

Back

Exits the screen and returns you to your user administration screen.

Reset

Resets the displayed table windows for projects 'not assigned' and 'assigned to' to the last point at which the assigned projects were saved.

Save

Saves in the noted employee's set of assigned projects all projects listed in the "Projects Assigned to" table.

Help

Opens a new web page displaying help for your current screen.

Assigning To

The name of the employee to whom projects are being assigned.

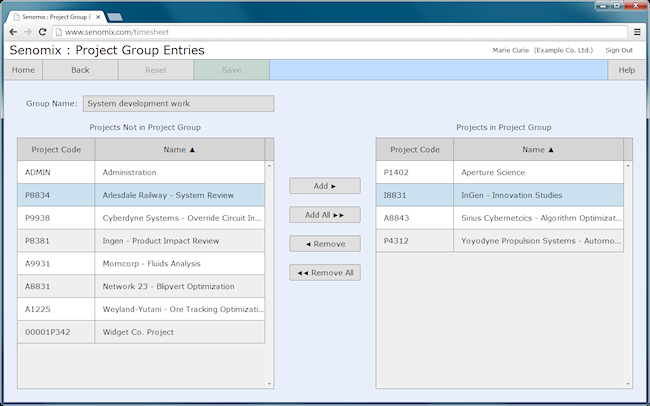

Projects Not Assigned

Lists all projects which are not assigned to the noted employee.

Projects Assigned to

Lists all projects assigned to the noted employee.

Add

Adds the project selected in the "Projects Not Assigned" table to the "Projects Assigned to" table.

Add All

Adds all projects listed in the "Projects Not Assigned" table to the "Projects Assigned to" table.

Remove

Removes from the noted employee's assigned projects the project selected in the "Projects Assigned to" table.

Remove All

Removes all projects from the noted employee's assigned projects.

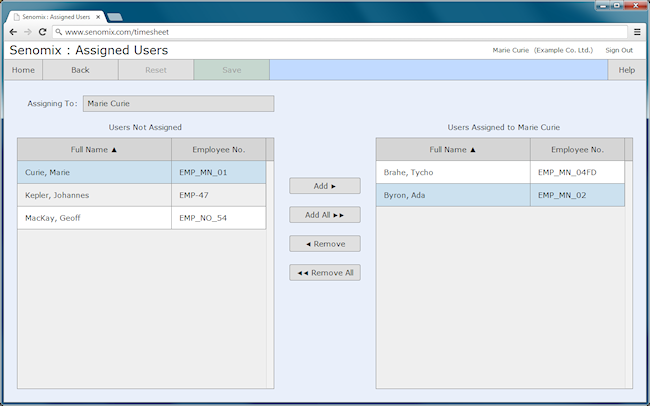

Your assigned users screen allows you to designate employee user accounts to be in the scope of responsibility of another employee. A system user with employee accounts placed in their scope of responsibility can review and approve timesheets for those employees (through their approve timesheets screen), or have their reports (through the reports application) limited only to the users assigned to them.

An administrative user signed in to their administration application will always be able to access all user accounts for reports and timesheet approval. User assignment only limits access for timesheet approval in the timesheet entry application, or report creation through the reports application.

If no users are assigned to an employee's user account, and that employee's user account has been granted reports access, that person will be able to create reports for all system users by default. Adding specific user accounts to a managerial employee's assigned users will ensure that only information for those users will be available through their reports application.

This screen is reached from your user administration screen.

The buttons and fields provided on this screen are as follows:

Home

Exits the screen and returns you to your main menu.

Back

Exits the screen and returns you to your user administration screen.

Reset

Resets the displayed table windows for users 'not assigned' and 'assigned to' to the last point at which the assigned users were saved.

Save

Saves in the noted employee's set of assigned users all employees listed in the "Users Assigned to" table.

Help

Opens a new web page displaying help for your current screen.

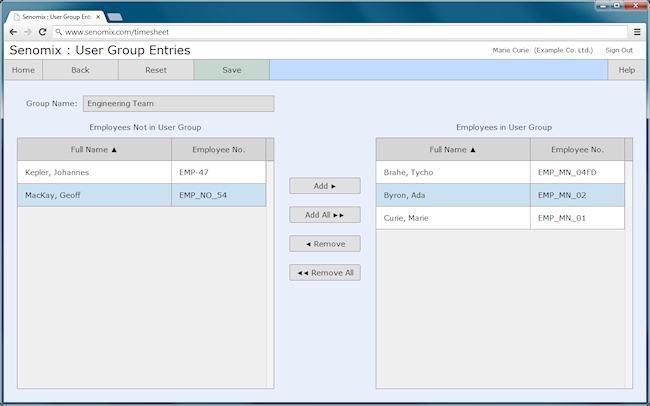

Assigning To

The name of the employee to whom user accounts are being assigned.

Users Not Assigned

Lists all user accounts which are not assigned to be in the noted employee's scope of responsibility.

Users Assigned to

Lists all user accounts assigned to be in the scope of responsibility for the noted employee.

Add

Adds the user record selected in the "Users Not Assigned" table to the "Users Assigned to" table.

Add All

Adds all user records listed in the "Users Not Assigned" table to the "Users Assigned to" table.

Remove

Removes from the noted employee's assigned users the user record selected in the "Users Assigned to" table.

Remove All

Removes all user records from the noted employee's assigned users.

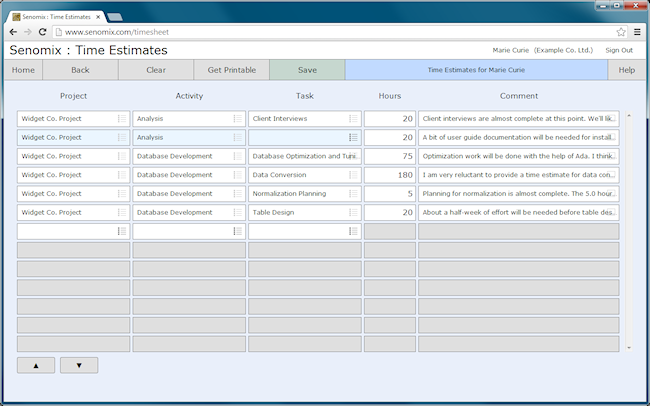

Your time estimates screen allows you to review the time estimates entered by an employee for their planned work. The items listed in this screen can be edited and re-saved to adjust the employee's provided work estimates.

This screen is reached from your user administration screen after selecting the user record of interest and clicking the "Time Estimates" button to retrieve the selected employee's estimates.

The buttons and fields provided on this screen are the same as those available in the time estimates screen of your time and expense entry application.

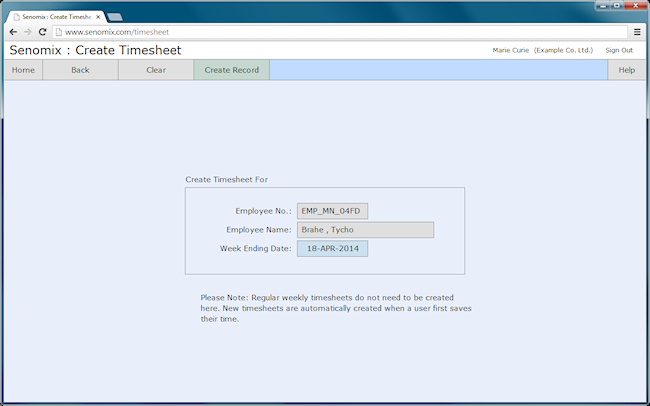

Your create timesheet screen allows you to create a timesheet for an employee who may have missed time entry for a past week.

Since timesheet records are automatically created whenever a user saves their time, and since past and future timesheets can be created by employees by moving forward or back in weeks from their timesheet screen, this screen should only be needed in exceptional situations (such as if a timesheet was noticed to be missing for a week ending date many months in the past).

This screen is reached from your user administration screen:

The buttons and fields provided on this screen as follows:

Home

Exits the screen and returns you to your main menu.

Back

Exits the screen and returns you to your user administration screen.

Clear

Clears the week ending date field, allowing you to select a new date for timesheet creation.

Create Record

Creates a new timesheet for the selected employee using the week ending date provided.

Help

Opens a new web page displaying help for your current screen.

Employee No.

Displays the employee number of the employee whose user account is selected.

Employee Name

Displays the name of the employee whose user account is selected.

Week Ending Date

Allows you to choose the week ending date for the timesheet to be created for the selected employee.

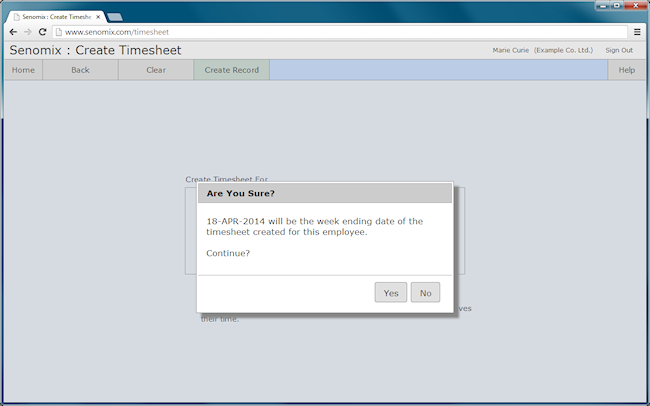

After selecting the week ending date for the timesheet you would like to create, click the Create Record button. You will then be prompted to confirm the week ending date of the timesheet to be created:

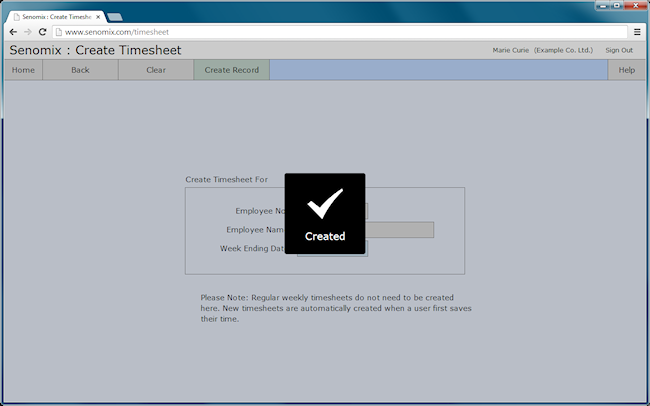

After confirming the timesheet week ending date is correct, click the Yes button to create the missing record. Notice of the timesheet's successful creation will then be shown:

If a timesheet already exists for your chosen user and week ending date, your new record creation will be blocked. If your intended timesheet already exists, you will want to examine that record through your timesheet administration screen rather than attempting to create it here.

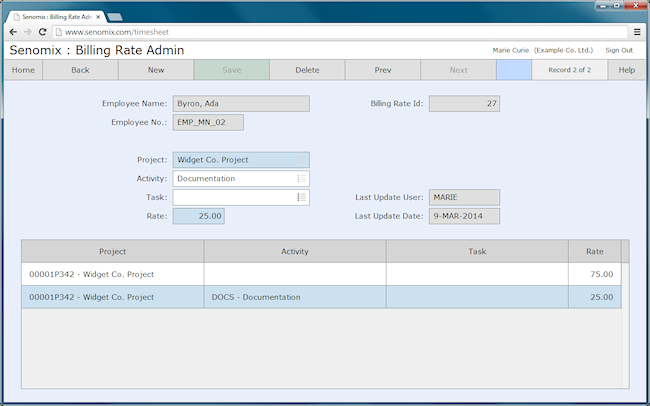

Your billing rate administration screen shows all non-default billing rates to be applied to an employee's recorded time. Rates entered in this screen override the default rates set for projects and employee user accounts.

This screen is only needed if an employee will have a different billing rate than that set for the project or for their default rate. If all employees assigned to a project will be billed out at the same hourly rate, or if you will not be using Senomix for the calculation of client billing, you will not need to use this screen.

This screen is reached from your user administration screen and will display only those billing rates assigned to the selected user.

The buttons and fields provided on this screen are as follows:

Home

Exits the screen and returns you to your main menu.

Back

Exits the screen and returns you to your user administration screen.

New

Clears the screen to prepare it for entering a new billing rate.

Save

Saves to your database any changes made to the selected billing rate.

Delete

Deletes the selected billing rate from your database.

Prev

Selects the previous billing rate displayed in the screen's table window.

Next

Selects the next billing rate displayed in the screen's table window.

Help

Opens a new web page displaying help for your current screen.

Employee Name

The name of the employee to whom the displayed billing rates apply.

Employee No.

The employee number of the employee to whom the displayed billing rates apply.

Project

The project to which the displayed billing rate is to be applied.

Activity

The activity to which the displayed billing rate is to be applied.

Task

The task to which the displayed billing rate is to be applied.

Rate

The per-hour rate to be applied to the displayed project, activity and task.

Billing Rate Id

Displays the system-assigned id of the selected billing rate.

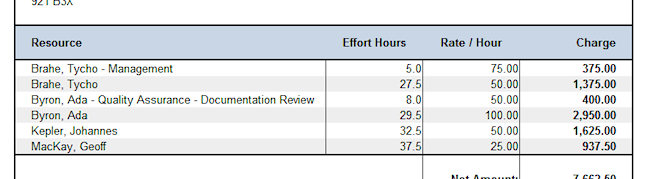

If a billing rate is saved for a project, activity, and task, that rate will be applied to any time recorded against those items when an invoice or other billing report is created for an employee's time. For example, considering the rates shown in the screen above, any time which Ada Byron recorded to the Widget Co. Project would be charged at the rate of 75.00 dollars (or pounds, euros, etc. as appropriate) per hour booked to any Widget Co. Project activity or task, except for the Widget Co. Project Documentation activity, for which the rate would be 25.00 per hour.

If no specific billing rates were entered for Ada Byron, her time would be charged at the default rate set for the Widget Co. Project (as described for the project administration screen in Section 3.8) or the default rate set for her in her user account (as described for the user administration screen in Section 3.2).

Billing rates are prioritized in your system as follows:

Specific rates entered for an employee in the billing rates screen

[are used before]

User account default rates

[are used before]

Project default rates

If a billing rate is set for a user and project in the billing rate administration screen, that rate will have priority above all default rates.

If an employee has a default rate set in their user account and has recorded time to a project which also has a default rate, the default user account rate will be used when creating invoices and other reports.

If an employee does not have a default rate set in their user account and does not have a billing rate noted for a project in their billing rate administration screen, the default rate set for the project will be used when creating invoices and other reports.

Your project administration screen allows you to create and modify projects for use in recording time and expenses. Each project should represent a distinct piece of contracted or deliverable work (for example, a particular software project, an ad campaign, an architectural fit-up), or an on-going relationship with a client if your work does not have a distinct completion date (for example, facilities maintenance, building security, or consulting services for a particular company).

This screen is reached from your main menu.

Individual projects can be grouped together for reporting and record querying purposes as Project Groups (as described in Section 3.21 of this guide). For example, all projects related to a particular client could be referenced together under a project group with that client's name.

An internal Administration project can also be used to record all non-billable items which will occur during the course of your staff work. For example, time off for vacation, sick time, internal meetings, or non-billable travel time could all be recorded under a single Administration project used by your company.

Activities and tasks for a project can be defined as distinct items which are referenced only by that one project (for example, an internal Administration project acting as the only project under which time off for vacation or illness is recorded, or a bespoke project which requires a distinct type of work not seen elsewhere in your organization) or as shared items which are recorded in a Project Template and applied to all projects of a certain type.

As described in section 1.1.1, project templates allow you to define a common set of activities and tasks which can be assigned to a project of a certain work type. For example, you could create a project template which held the activities and tasks related to all of your consulting engagements, or one which related to surveying jobs pursued by your organization.

A change made to a project template will be immediately reflected in the activities and tasks of all projects to which that template has been assigned, providing you with an easy way to update the structure of your work as products and services are added to your organization over time.

The buttons and fields provided on this screen are as follows:

Home / Back

Exits the screen and returns you to your main menu.

New

Clears the screen to prepare it for entering a new project.

Save

Saves to your database any changes made to the selected project.

Delete

Deletes the selected project from your database.

Prev

Selects the previous project displayed in the screen's table window.

Next

Selects the next project displayed in the screen's table window.

Help

Opens a new web page displaying help for your current screen.

Project Name

The name of the project. This will be the name by which the project is referred to by your organization.

Project Code

The internal project code which your organization uses to refer to this project.

Mail Address

A button which opens an edit screen in which you can enter the mailing address of the selected project.

Active

A checkbox which indicates whether or not the displayed project is active and available for recording time and expenses. Only active projects are available for reference in user timesheets and expense claims (all projects are always available through edits made in your administration application).

Template Used

A selector used to identify the project template in use, or to show that no template is used (with the project having distinct activities and tasks not referenced by any other projects). Once a template has been set for a project, it cannot be changed.

Templates

A button which leads to your Template Administration screen, allowing you to create project templates which contain the activities and tasks used in the various types of work engaged in by your organization.

Default Rate

The billing rate to be applied to any time recorded to this project in system timesheets. This value is used for billing calculations (such as invoice generation) and represents the dollars (or pounds, euros, etc.) billed for each hour of project work. If you will not be tracking billing for this project, or if you will be creating distinct billing rates for each employee involved in the work, this item can be left blank.

This rate can be overridden by entering a billing rate for a specific Senomix user in their user account settings, or by creating a billing rate entry for this project and a specific user in your Billing Rate Administration screen.

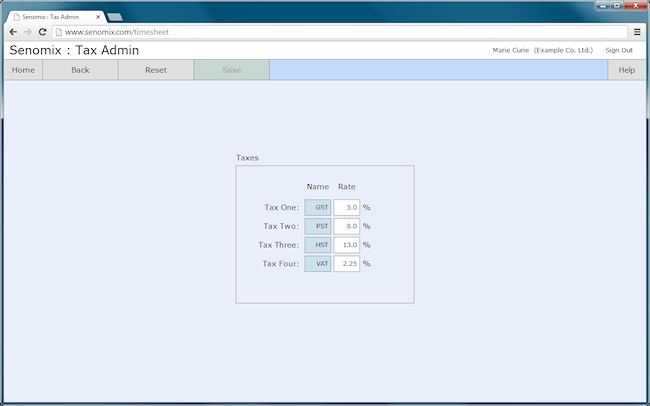

Apply [taxes]

Checkboxes which indicate which of the four available taxes defined in your Senomix system should be applied to this project. The names and rates of these taxes can be defined through your Tax Administration Screen, with the default items provided with Senomix being defined as GST, PST, HST and VAT.

Project Id

Displays the system-assigned id of the selected project.

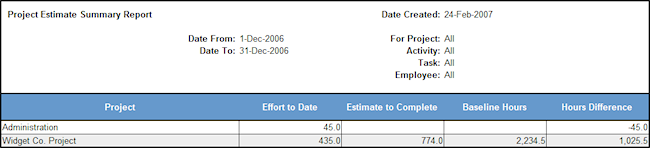

Est. Hours

The number of hours which the selected project is estimated to require for completion. This value can be used in various estimates vs. actuals and work in progress reports to track a project's progress against baseline time estimates.

Two fields are displayed on this line: An enterable value which indicates the total number of hours estimated for the project to be completed, and a non-enterable value which displays the total of estimates entered for the project and for all of its activities and tasks.

As described in the Activity and Task administration screens, time estimates can be entered for each component of work if a more granular set of time estimates are desired. Any value entered in the editable estimate field will be added to the activity and task estimate totals displayed in the non-enterable field. If estimate hours are not entered for any activities or tasks in the project (as would be the case when using an assigned project template), the non-editable total field will display the same value as that entered in the editable est. hours field.

Est. Complete

Displays the date on which the project is estimated to be complete. This value can be used in system reports, such as your Work in Progress report, to identify the status of your organization's work schedule.

Activities

A button which leads to your Activity Administration screen, displaying all activities assigned to the selected project. If the selected project has a template assigned, this button will be disabled (since no project-specific activities will be available).

A template's activities can be reviewed by clicking this screen's Templates button and selecting the project template of interest.

Showing All Projects / Showing Only Active

Toggles the display of project records to only show projects which are active, or to show both active and inactive projects.

To display all projects, toggle this button to read "Showing All Projects".

The table window in your project administration screen can be set to display records in order by Project Code or Project Name by clicking the corresponding table header.

A project record cannot be deleted if it is referenced in your system in timesheets or expense claims. If a project is referenced in your system's timesheet or expense claim information, all timesheets and claims associated with that project must first be edited to remove the project before the project can be deleted. Rather than deleting a project once it has been completed, it is best to simply inactivate it to remove it from selection in user timesheets.

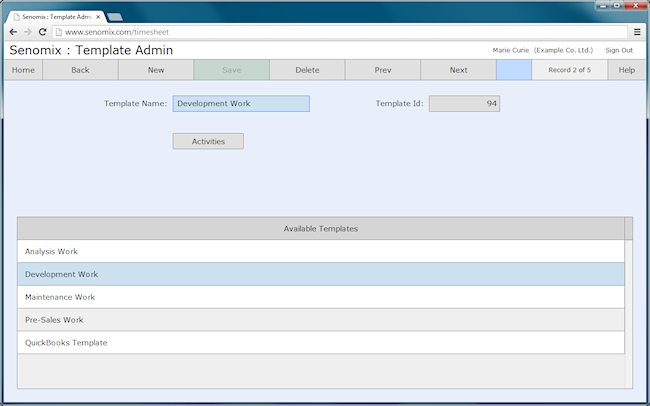

Your template administration screen provides a listing of all project templates which can be assigned to your Senomix projects. Each of your project templates will contain a set of activities and tasks which are common to the particular type of work identified.

For example, an 'Analysis Work' template may contain a variety of activities and tasks related to client interviews, documentation and deliverable reports. A 'Development Work' template may contain activities and tasks related to the creation of a particular type of application or physical construction.

Project templates allow you to create centralized sets of activities and tasks which can be assigned to multiple projects and managed from one location. As activities and tasks are added, edited or renamed in your templates, those changes will automatically appear in all projects which are assigned to use those templates.

This screen is reached from your project administration screen.

The buttons and fields provided on this screen are as follows:

Home

Exits the screen and returns you to your main menu.

Back

Exits the screen and returns you to your project administration screen.

New

Clears the screen to prepare it for entering a new template.

Save

Saves to your database any changes made to the name of the selected template.

Delete

Deletes the selected template from your database.

Prev

Selects the previous template displayed in the screen's table window.

Next

Selects the next template displayed in the screen's table window.

Help

Opens a new web page displaying help for your current screen.

Template Name

The name of the template. This should reflect the type of work covered by the template's activities and tasks.

Activities

Opens your activity administration screen, through which all activities and tasks assigned to the selected template can be adjusted.

Template Id

Displays the system-assigned id of the selected template.

You can assign your templates to your projects through the "Template Used" selector in your Project Administration screen. Once a template has been assigned to a project, all activities and tasks in the assigned template will be made available for use in that project.

The activities and tasks in a particular template can be reached by selecting the template of interest and clicking the 'Activities' button. A change made to the activities or tasks in a particular template will be automatically applied to all projects which reference that template.

If a template is assigned to one or more projects in your system, that template cannot be deleted.

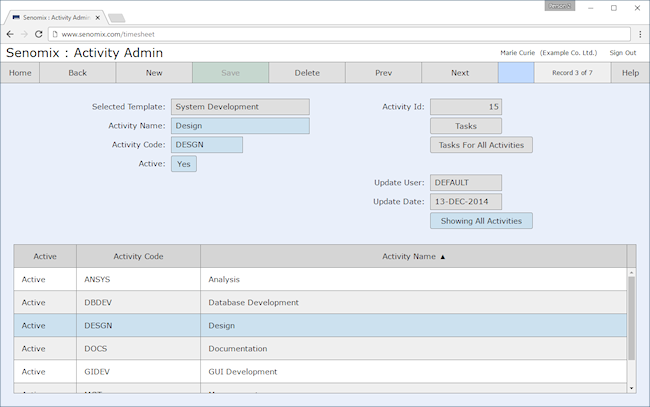

Your activity administration screen allows you to create and modify activities belonging to a project or project template. The activities created in this screen will be made available in your system timesheets and expense claims under the project or project template in which they have been created.

This screen is reached from your project or template administration screen.

The buttons and fields provided on this screen are as follows:

Home

Exits the screen and returns you to your main menu.

Back

Exits the screen and returns you to your project or template administration screen.

New

Clears the screen to prepare it for entering a new activity.

Save

Saves to your database any changes made to the selected activity.

Delete

Deletes the selected activity from your database.

Prev

Selects the previous activity displayed in the screen's table window.

Next

Selects the next activity displayed in the screen's table window.

Help

Opens a new web page displaying help for your current screen.

Selected Project /

Selected Template

The name of the project or project template to which the displayed activities belong.

Activity Name

The name of the activity. This will typically be the type of work against which time will be recorded at your office (for example, a general category such as 'Development', 'Maintenance', 'Documentation' or 'Quality Assurance').

Activity Code

The internal activity code which your organization uses to refer to this category of work. If activity codes are not used by your office, any unique value or number can be entered here.

Active

A checkbox which indicates whether or not the displayed activity is active and available for recording time and expenses. Only active activities are available for reference in user timesheets and expense claims (all activities are always available through edits made in your administration application).

Activity Id

Displays the system-assigned id of the selected activity.

Est. Hours

The number of hours which the selected activity is estimated to require for completion. This value can be used in various estimates vs. actuals and work in progress reports to track a particular activity's progress against baseline time estimates.

Estimated hours are only displayed for 'standard' projects. Activities entered under a project template will not display estimated hour or estimated completion date values.

Two fields are displayed on this line: An enterable value which indicates the total number of hours estimated for the activity to be completed, and a non-enterable value which displays the total of estimates entered for the activity and for all of its tasks.

As described in the Task administration screens, time estimates can be entered for each component of work if a more granular set of time estimates are desired. Any value entered in the editable estimate field will be added to the task estimate totals displayed in the non-enterable field. If estimate hours are not entered for any tasks in the activity, the non-editable total field will display the same value as that entered in the editable est. hours field.

A value is only required in the activity's estimated hours field if you believe hours will be billed at the activity level of your project. If time is only expected to be recorded by employees at the task level of your project, estimated hours should be left for individual tasks.

Est. Complete

Displays the date on which the activity is estimated to be completed. This value can be used in system reports, such as your Work in Progress report, to identify the status of your organization's work schedule.

Estimated completion dates are only displayed for 'standard' projects. Activities entered under a project template will not display estimated completion date or estimated hour values.

Tasks

A button which leads to your Task Administration screen, displaying all tasks assigned to the selected activity.

Tasks displayed after clicking this button will only appear beneath the selected activity. To create tasks which will appear for all activities in your project template, use the Tasks For All Activities button.

Tasks For All Activities

A button which leads to your Task Administration screen, displaying tasks which are to be assigned to all activities in the template.

If you have tasks which you would like to see appear under all activities in your project, use this button to access that universal task list.

This option is only available for project templates (not 'standard' projects).

Showing All Activities / Showing Only Active

Toggles the display of activity records to only show activities which are active, or to show both active and inactive activities.

To display all activities, toggle this button to read "Showing All Activities".

The table window in your activity administration screen can be set to display records in order by Activity Code or Activity Name by clicking the corresponding table header.

An activity record cannot be deleted if it is referenced in your system in timesheets or expense claims. If an activity is referenced in your system's timesheet or expense claim information, all timesheets and claims associated with that activity must first be edited to remove the activity before it can be deleted. Rather than deleting an activity once it has been completed, it is best to simply inactivate it to remove it from selection.

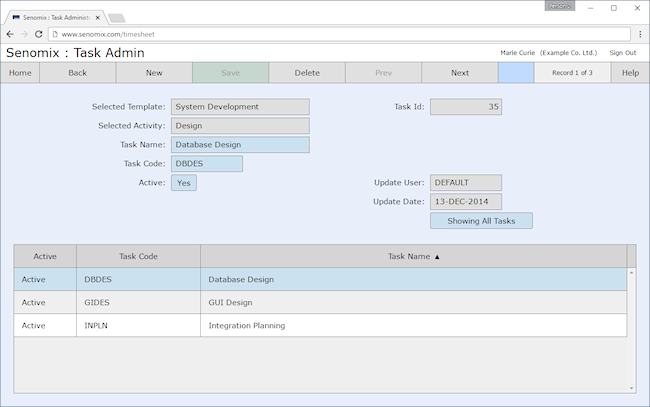

Your task administration screen allows you to create and modify tasks belonging to a project or project template's activities. The tasks created in this screen will be made available in your system timesheets and expense claims under the project or project template activity in which they have been created or (if called using the Tasks For All Activities button) for all activities in your project template.

This screen is reached from your activity administration screen.

If your tasks are to be available for a particular activity only, you will see the name of that activity noted in the "Selected Activity" field. In the screen shown above, the displayed tasks will appear beneath the "Design" activity only.

If your tasks are to be available for all activities in your project template, the text "ALL ACTIVITIES" will be shown in the "Selected Activity" field.

The buttons and fields provided on this screen are as follows:

Home

Exits the screen and returns you to your main menu.

Back

Exits the screen and returns you to your activity administration screen.

New

Clears the screen to prepare it for entering a new task.

Save

Saves to your database any changes made to the selected task.

Delete

Deletes the selected task from your database.

Prev

Selects the previous task displayed in the screen's table window.

Next

Selects the next task displayed in the screen's table window.

Help

Opens a new web page displaying help for your current screen.

Selected Project /

Selected Template

The name of the project or project template to which the displayed tasks belong.

Selected Activity

The name of the activity to which the displayed tasks belong, or the text "ALL ACTIVITIES" if the listed tasks are to appear in all activities in the selected project template.

Task Name

The name of the task. This will typically be the lowest detail level at which time will be recorded at your office (for example, a specific work item such as 'Database Design', 'Documentation Review', 'Painting', 'Delivery', 'Client Meetings', etc.).

Task Code

The internal task code which your organization uses to refer to this item of work. If task codes are not used by your office, any unique value or number can be entered here.

Active

A checkbox which indicates whether or not the displayed task is active and available for recording time and expenses. Only active tasks are available for reference in user timesheets and expense claims (all tasks are always available through edits made in your administration application).

Task Id

Displays the system-assigned id of the selected task.

Est. Hours

The number of hours which the selected task is estimated to require for completion. This value can be used in various estimates vs. actuals and work in progress reports to track a particular task's progress against baseline time estimates.

Estimated hours are only displayed for 'standard' projects. Tasks entered under a project template will not display estimated hour or estimated completion date values.

Est. Complete

Displays the date on which the task is estimated to be completed for your project. This value can be used in system reports, such as your Work in Progress report, to identify the status of your organization's work schedule.

Estimated completion dates are only displayed for 'standard' projects. Tasks entered under a project template will not display estimated completion date or estimated hour values.

Showing All Tasks / Showing Only Active

Toggles the display of task records to only show tasks which are active, or to show both active and inactive tasks.

To display all tasks, toggle this button to read "Showing All Tasks".

The table window in your task administration screen can be set to display records in order by Task Code or Task Name by clicking the corresponding table header.

A task record cannot be deleted if it is referenced in your system in timesheets or expense claims. If a task is referenced in your system's timesheet or expense claim information, all timesheets and claims associated with that task must first be edited to remove the task before it can be deleted. Rather than deleting a task once it has been completed, it is best to simply inactivate it to remove it from selection.

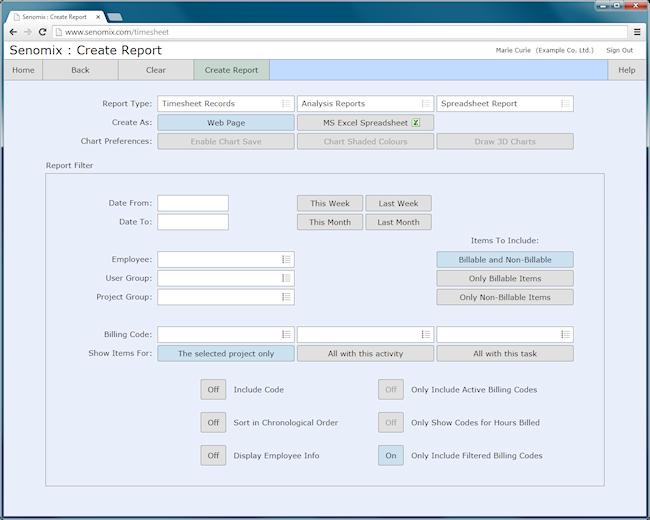

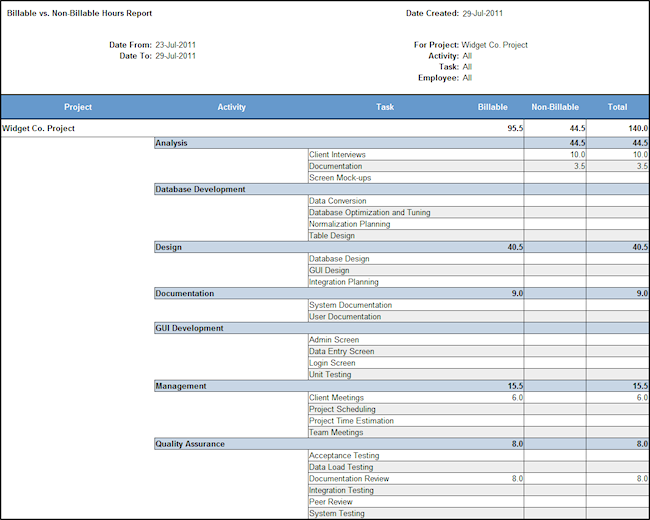

Your create report screen allows you to create reports for the review and analysis of your office's recorded timesheet and expense claim information.

This screen is reached from your administration or reports application's main menu screen:

The buttons and fields provided on this screen as follows:

Home / Back

Exits the screen and returns you to your main menu screen.

Clear

Clears all report filter elements, resetting the report filter to that set for your chosen report.

Create Report

Requests a report with the report filter and output options you have selected.

Help

Opens a new web page displaying help for your current screen.

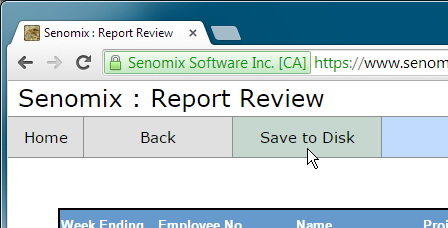

Report Review

Created Web Page reports will be opened for display in your Report Review screen. In that screen, you can choose to save your report to your computer's hard drive by clicking the green "Save to Disk" button:

After clicking the "Save to Disk" button, your report will be saved to your computer's Downloads folder and be available for your review in a new web browser window. Depending upon your web browser's behaviour for saving files, you may be presented with a "Save As" dialog box, a "File Saved" notification or, as with Mac OS X Safari, your file may be silently saved to your computer without showing any notification message at all.

Using Mac OS X Safari?

Please note: The Safari web browser provided with Mac computers

will save your reports to your Downloads folder

without displaying a confirmation message.

After selecting 'Save to Disk' or creating an export report,

you will be able to find your saved report files in your Downloads folder.

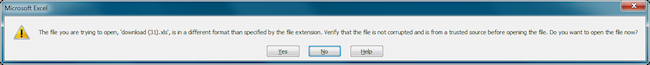

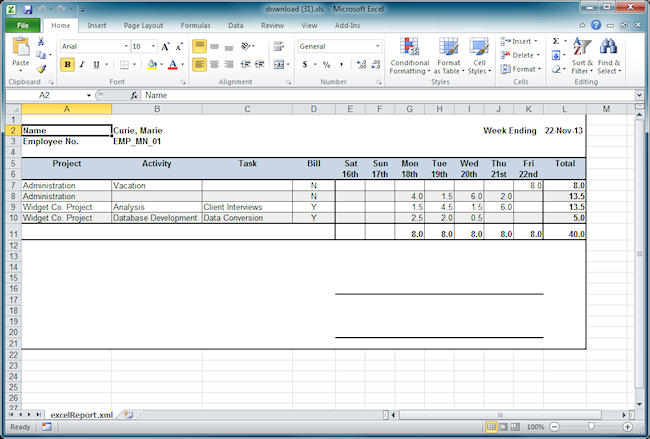

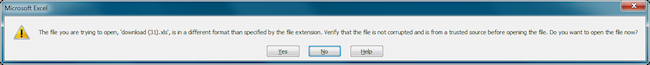

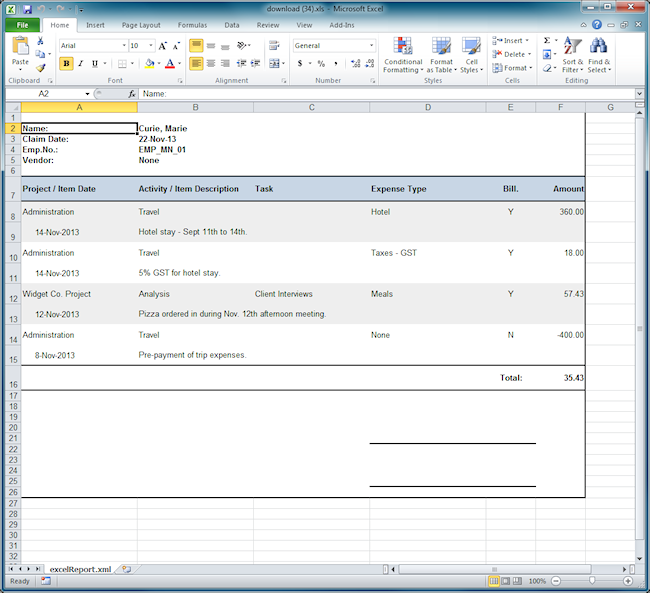

When creating a report for Microsoft Excel, your report will be saved to your computer's Downloads folder with the name of "senomixReport.xls" and (for the behaviour of most web browsers) be automatically opened in Excel for your review.

When creating data export reports, your report will be automatically saved to your computer's Downloads folder in the file format expected for that export. The filename used for your report will describe its contents.

As reports are saved, they will be numbered for you (for example, "senomixReport (12).xls") in the order they are created. You can rename your saved reports as you would like, and we recommend deleting old reports from your Downloads folder or moving them to your personal directories once they are no longer required for your immediate reference.

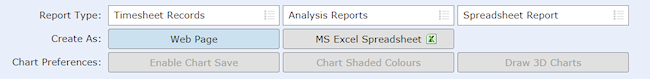

Report Type

The report type section of your screen:

Allows you to choose the report you would like to create and the format in which it will be created. Reports can be created as html web pages or as formatted Microsoft Excel spreadsheets (the option to which these buttons are reset to can be chosen in your application settings screen). Data export reports will always be created as plain text before being saved to your computer's Downloads folder.

Report options for timesheet or expense claim records are available, with available categories of analysis, estimate, financial, and export reports providing a list of available reports in the rightmost selector.

The reports listed will change depending upon the report type and category you have chosen, with the reports covering data analysis, estimate, etc. as appropriate for your selection.

If your reports access rights are restricted to non-financial or personal reports, the reports available to you will be limited accordingly. For example, if your user account was set to have access only to non-financial reports, expense claims would not be available for your reports, and timesheet report options for financial and export reports would also be blocked from your use.

If a report option does not require a particular report filter item, those selection options will be disabled when your report is selected. For example, an Incomplete Timesheets report has no need for the employee, user group, project group, billing code or billable state selectors, and so those items will be cleared and disabled for that report option.

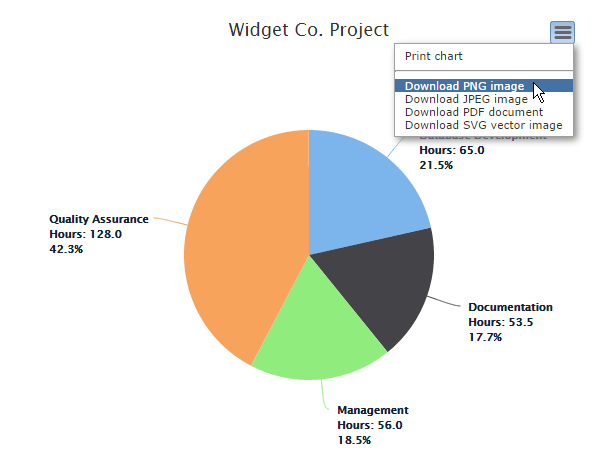

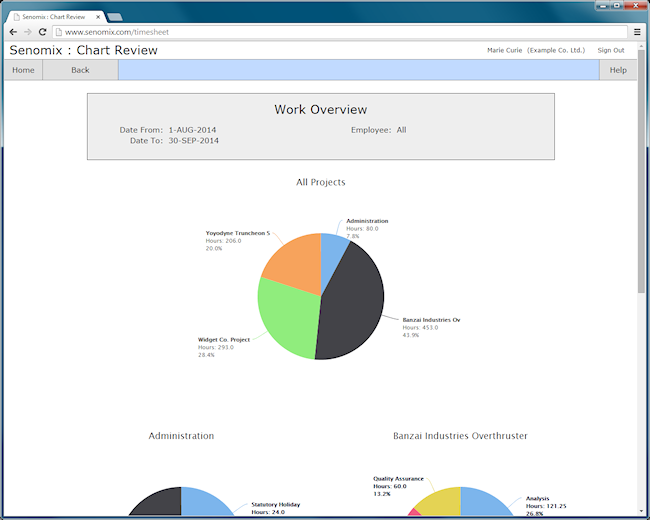

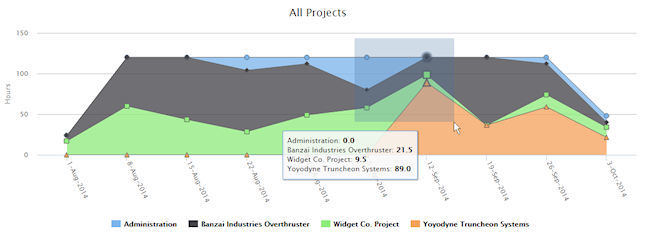

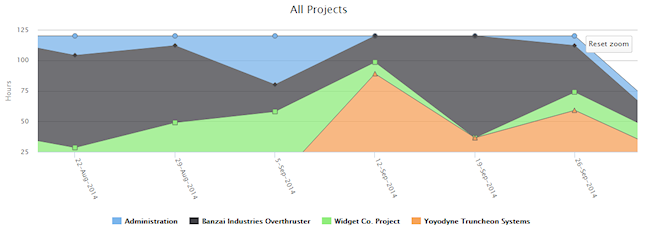

The options for chart reports allow you to add options for saving the chart images (for example, if you wished to save a chart for attachment within an offline document) or adjusting its colours and orientation to provide a more presentation-friendly appearance. These options are only enabled when a chart report has been selected.

The Enable Chart Save option will add a save widget to each chart presented in your chart review screen, providing a selection menu which will allow you to print or save the chart image as you would prefer:

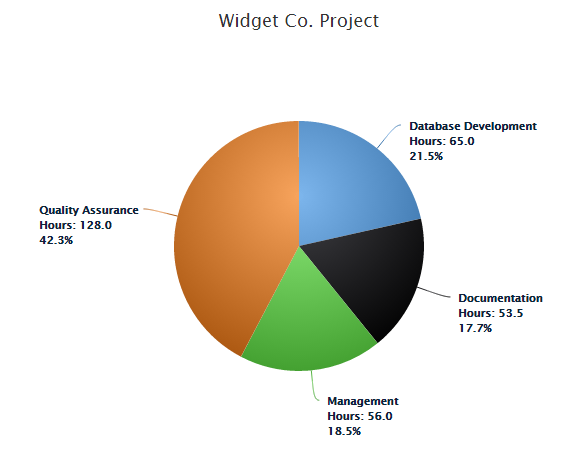

The Chart Shaded Colours option will add a gradient fill shading to your charts:

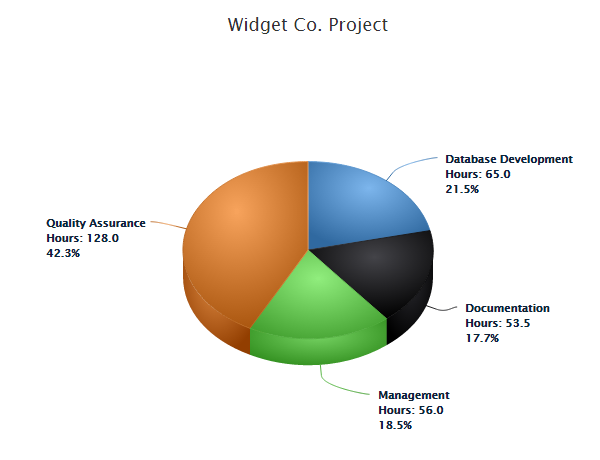

With the Draw 3D Charts option displaying your output with a 3D orientation (only available for pie charts):

Examples of all reports provided through these options can be found later in this section, with chart examples provided in the chart review screen section which follows.

Report Filter

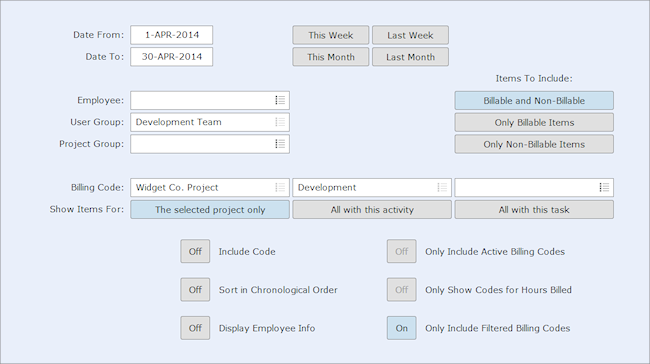

The report filter section of your screen:

Allows you to refine the data which will appear in your report by specifying date ranges, groups of employees, particular projects, or shared project codes as suits your preference. For example, you could request a report which displays all Analysis work performed by your Engineering group of employees for all work related to the Widgets Inc. company for the month of July.

A description of each of these filter elements, along with examples of how and why you might use them, are described below.

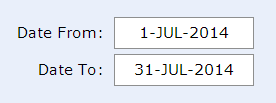

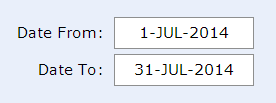

Date From / Date To

What this does:

The Date From / Date To filter allows you to set a distinct date range for your reports. For example, selecting the dates 1-Jul-2014 and 31-Jul-2014 would result in your report containing time or expenses recorded within the month of July, 2014:

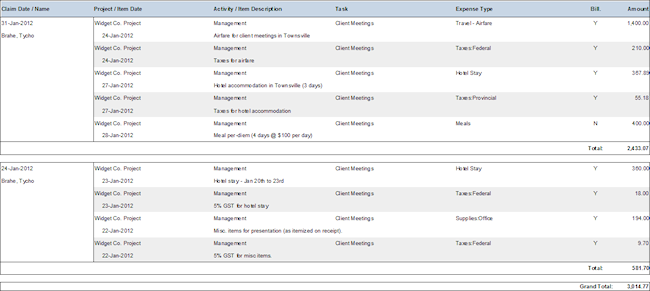

Please note: All reports consider the individual timesheet or expense claim item dates when creating their output, with the exception of the Expense Claim Listing report and all Expense Claim Data Export reports. Those reports use the Claim Date for determining which expense claim records to include in the report output and do not consider the dates of the individual expense claim items.

Why you would use this option:

Almost all reports you will want to create will cover only a certain time period of interest (for example, all time for a certain month). The Date From / Date To filter allows you to specify the date range of interest to you.

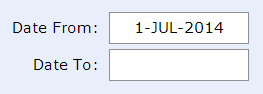

If either of the Date From or Date To filters are left blank, all time or expenses on or after, or on before the specified date will be included in your report. For example, setting a Date From of July 1st, 2014 and leaving the Date To blank:

Would result in your report including all time or expenses which were recorded as occurring on or after July 1st, 2014.

If both the Date From and Date To filters are left blank, your report will contain all hours or expenses for all time.

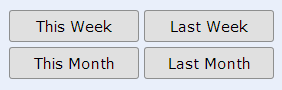

Date Preset

What this does:

The Date Preset buttons allow you to set the Date From and Date To filters with a single button click.

For example, if the date 'today' was July 19th, 2014, when the This Month button was clicked, the Date From and Date To filter would be set for the month of July, 2014:

Why you would use this option:

Your date presets provide a quick way to set recent date ranges of interest.

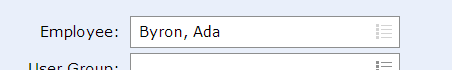

Employee

What this does:

The Employee filter allows you to set your report to only include time or expenses entered by a particular employee. For example, selecting the employee "Ada Byron":

Will result in your report only containing hours or expenses which have been entered in Ada's timesheets or expense claims

Why you would use this option:

If you wanted to create a report which only showed the time or expenses recorded by a single employee.

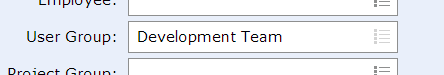

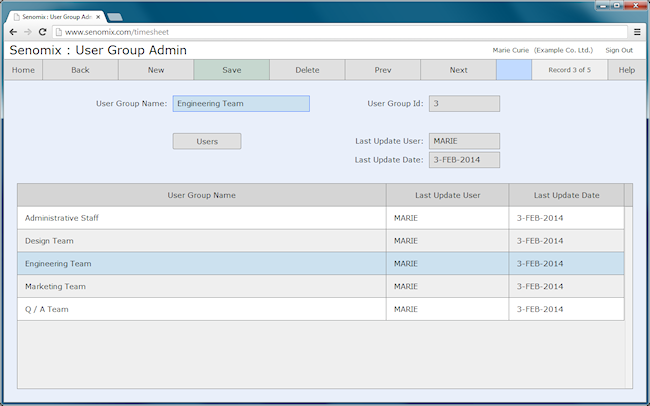

User Group

What this does:

The User Group filter allows you to set your report to only include time or expenses entered by a particular group of employees. For example, if a User Group named "Development Team" was created in your system which included the employees Ada Byron, Tycho Brahe and Geoff MacKay, selecting that User Group:

Would result in your report only containing time or expenses entered for those three employees in the "Development Team" group.

Why you would use this option:

User Groups allow you to create reports which reflect the effort of an identified group of employees. For example, if you were interested in reviewing how time was spent by the administrative staff of your office.

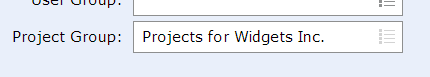

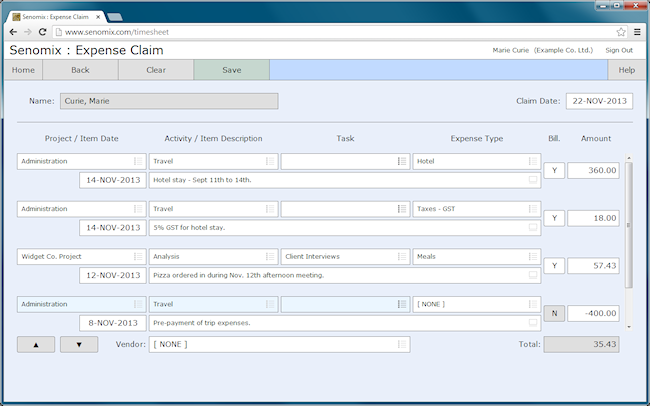

Project Group

What this does:

The Project Group filter allows you to set your report to only include time or expenses recorded to a particular group of projects. For example, if a Project Group named "Projects for Widgets Inc." was created in your system which included the projects for "Widget Co. - Data Management System", "Widget Co. - Quality Assurance Analysis" and "Widget Co. - Systems Analysis", selecting that Project Group:

Would result in your report only containing time or expenses entered for those three projects in the "Projects for Widgets Inc." group.

If your report is filtered to include a project group, the group's name will be attached to your report's title (for example, "Work in Progress Report - Projects for Widgets Inc.").

If you are using a project group to filter your report, the Billing Code filter option for "The selected project only" (as described below) cannot be used (though you can use the "All with this activity" and "All with this task" options). If a specific project is of interest to you, it should be added to your preferred project group.

Why you would use this option:

Project Groups allow you to create reports which consolidate the hours and expenses recorded for multiple projects. If there are a number of projects for which you would like to see the effort hours or expenses collected together, you can accomplish that by using a Project Group.

For example, if all work of a certain type (systems analysis, advertising, maintenance work, etc.) was of interest, a project group which contained projects of that type could be created. Similarly, project groups can be created to categorize projects performed for different clients (for example, all work performed for the "Widgets Inc." company, as shown above), or for projects which were found to be of internal project management interest (for example, work which was performed ahead of or behind schedule).

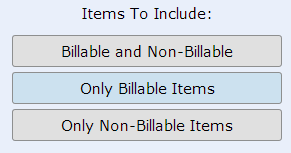

Billable Items To Include

What this does:

The Items To Include filter allows you to specify whether the time and expenses included in your report are only for billable items, only for non-billable items, or are for both billable and non-billable items. For example, to create a report which included only time or expenses indicated as being billable, the following filter option would be set:

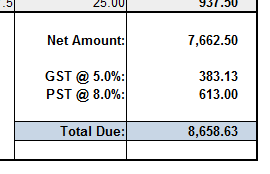

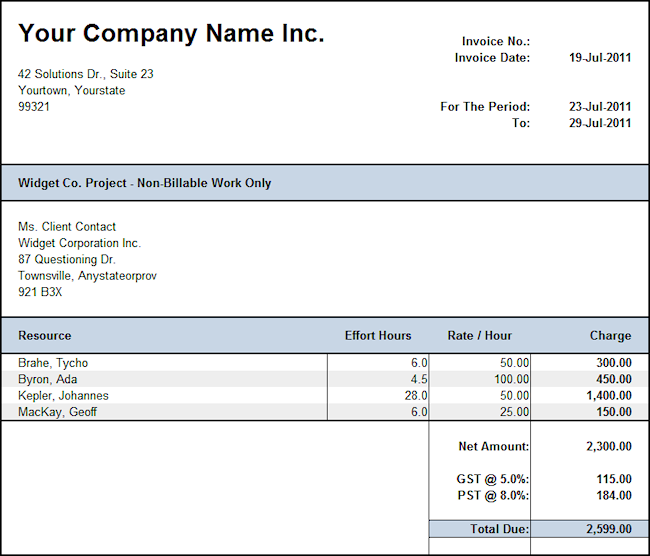

If a report is filtered as only including billable or only including non-billable time, a note will be attached to the report's title indicating that the report is for "Billable Work Only" or "Non-Billable Work Only", respectively. If both "Billable and Non-Billable" items are included, no indicating text will be added to your report's title.

For invoice reports, a note that the invoice is for "Non-Billable Work Only" will be added to the project name listed on the invoice if the "Only Non-Billable Items" option is chosen. A regular invoice for billable work will have no further clarification added.

Why you would use this option:

The Billable Items to Include filter allows you to create reports which include only billable or only non-billable time or expenses, allowing you to see how much time or expenses have been recorded in your projects for each option. This filter can be disregarded by keeping it at the "Billable and Non-Billable" option (so, including all expenses and effort hours regardless of whether or not time or expenses were recorded as being billable).

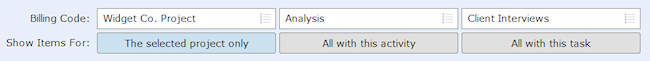

Billing Code / Show Items For

What this does:

The Billing Code and Show Items For options are used together to identify the project, activity or task of interest for your report.

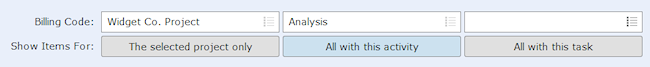

For example, if you were interested in viewing the work recorded on the Widget Co. Project's Analysis activity for Client Interviews, those items would be set in your Billing Code selectors:

Your Show Items For option identifies how your chosen Billing Code is to be used for filtering your report data.

If you would only like to see only time or expenses entered for the selected billing code (for this example, only items which have been recorded to "Widget Co. Project - Analysis - Client Interviews"), the option for "The selected project only" should be chosen. This indicates that your report will only include items for the billing code entered, with all other data excluded from your report.

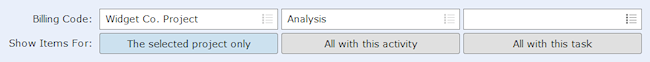

For example, if you wanted to see all time recorded to the Analysis activity of the Widget Co. Project (so, include all tasks listed under that activity, in addition to any time billed to the activity itself), you would select:

And to see all time or expenses to the Widget Co. project, regardless of the activity or task under which they were recorded, you would select the project of interest while setting the Show Items For filter to indicate "The Selected Project Only":

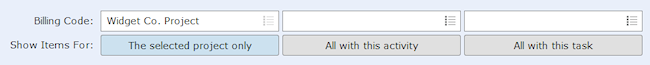

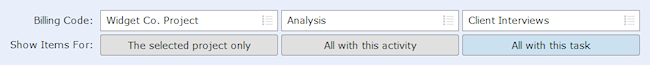

If you wanted to retrieve all time or expenses recorded to a specific activity, regardless of the project under which those items have been recorded, you would select the "All with this activity" option, as with this example:

A report created with this filter option set would include all items recorded to the "Analysis" activity, regardless of the project under which that work had been recorded. For example, if "Analysis" was used in work for the projects "Widget Co. - Data Management System", "Widget Co. - Quality Assurance Analysis" and "Widget Co. - Systems Analysis", all time or expenses recorded to "Analysis" for those projects would be included in the returned report.

Your reports can also be set to display items for a common task across the projects recorded in your system by using the "All with this task" option, as with this example:

Which would include all time or expenses recorded to the "Client Interviews" task, regardless of the project or activity under which that work was recorded.

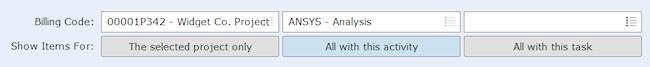

Report filters for 'all activities' and 'all tasks' use the activity/task code attribute of the activity or task selected to determine if they are the same activity or task across projects (and so should be included in the report). For example, if we set Senomix to show the project/activity/task code attributes in the billing code listing and repeated one of the above examples:

We can see that the common activity code by which activities will be matched for the selection is "ANSYS". So, for the above selection, your report would include all work which has an activity with the code of "ANSYS".

For reports filtered on common activities and tasks, the name is ignored and the element of common interest is the project/activity/task code. The code attribute (which is defined in each of your project, activity and task administration screens) can correspond with an internal reference value used to record work in your office, or can be an abbreviation of the type of work recorded.

Activity and task codes will always be identical for your recorded work if a shared project template is used for the definition of your projects. If different project templates are used in your office to record time for different project types (or if projects are defined in your office with separate activity and task listings), you should ensure that codes for the same types of work are identical to allow the use of your "Show items for" option.

Why you would use this option:

You can use your Billing Code and Show Items For options to view information about specific projects, activities and tasks, reviewing the effort hour data recorded for that work. For example, a Work in Progress report created for the Widget Co. Project would allow you to see how much time was spent on various aspects of that work, and perhaps where scheduling problems may have occurred as time progressed.

As with all other report filter elements, the Billing Code and Show Items For options can be used along with other report filter elements, allowing you to view a more refined slice of recorded time and expense data. For example, you could view all Analysis work which the Engineering user group performed for all projects you have grouped together as being ahead of schedule, which might help identify if time performed in analysis had an impact in improved performance later in project work.

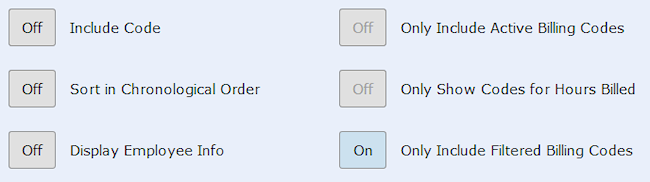

Formatting Checkboxes

What this does:

Your output formatting checkboxes allow you to adjust the content and appearance of some time and expense reports. If a checkbox option is disabled (such as the "Only Show Codes for Hours Billed" checkbox shown below), that option cannot be changed from its default setting for the report.

The options provided by these checkboxes are:

Include Code

Indicates whether or not your report should add the code of a project/activity/task code to the displayed output.

If selected, the code will be added to the beginning of each project, activity and task name displayed in the report, with a hyphen separating the two values.

Sort in Chronological Order

Indicates whether your report output is to be displayed in chronological order (with the checkbox set On) or reverse-chronological order (with the checkbox set Off). In cases where a report does not display records in chronological order, this option will be disabled.

Display Employee Info

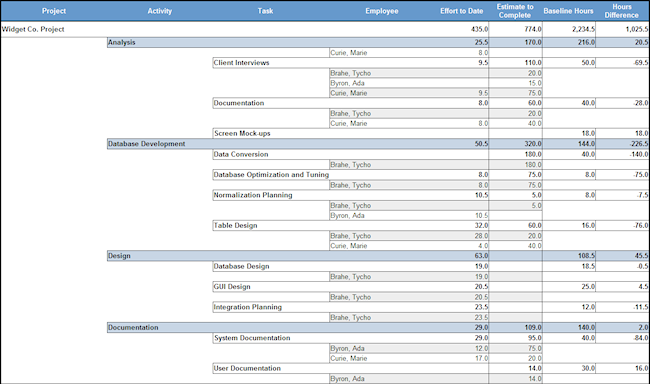

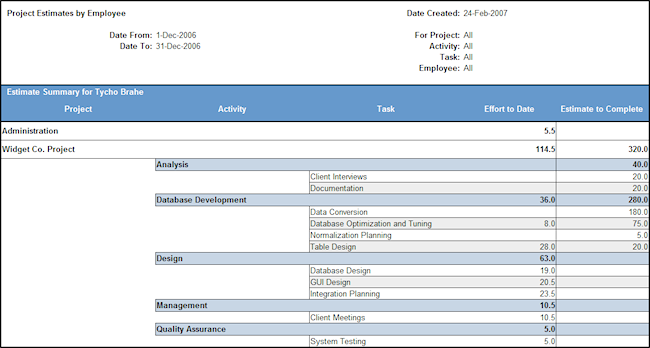

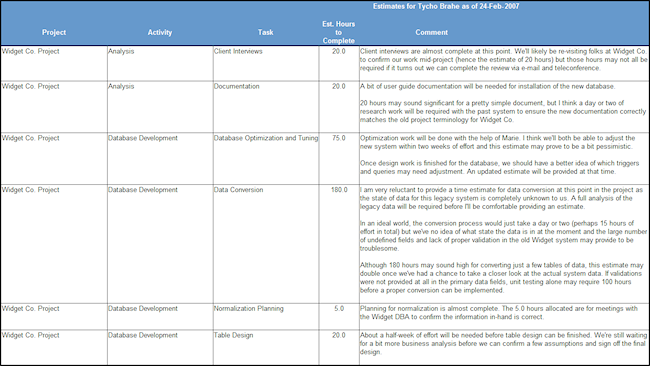

Indicates whether additional employee information should be included in your report. For example, for the Project Estimates report, an additional breakout of employee information can be included in the report by setting this option On.

Only Include Active Billing Codes

Indicates whether or not your report should only contain billing codes which are listed as being active. If selected, the report will display "(active work only)" alongside the report title to indicate this active filter item.

If this checkbox is set On, the report will only list those projects, activities, or tasks which have their Active state set On.

Only Show Codes For Hours Billed

Indicates whether or not your report should show only those billing codes which have time or expenses recorded to them. If selected, your report will not display any billing codes which have zero time or expenses recorded to them (and so would be displayed as blank in your report). If not selected, your report will display all of a Project's billing codes, regardless of whether or not time or expenses have been billed to them.

Only Include Filtered

Indicates whether or not your report should only contain billing codes which correspond to the project, activity and task billing codes noted in the filter for your report.

If set On, your report will only include those entries which relate to your selected project, activity or task. The Spreadsheet Report, for example, will output all entered lines of all timesheets which include the project of interest to you unless this option is set On (in which case only the project of interest will be displayed in the timesheet listing).

If this checkbox is set Off, your report will include all entries for the records included in the result set. For example, by leaving this option Off when creating a Spreadsheet Report, you will be able to see all time recorded in weeks during which a certain project was worked upon.

User accounts can be set to have varying levels of reports access. Rather than provide an employee with full administrative rights, full, non-financial or personal reports access can be given to an employee to allow them to create reports for themselves or the staff in their scope of responsibility by using the "Manager and Personal Reports" sign-in option.

Reports access rights are set for user accounts in your user administration screen, with those access rights having the following effects in your create report screen:

Non-Financial Reports Access

If your Create Report Screen is being viewed in your reports (not administration) application, and you have your access rights set to Non Financial Reports Only, none of the Expense Claim, Financial or Data Export reports will be available.

Personal Reports Only Access

If your Create Report Screen is being viewed in your reports (not administration) application, and you have your access rights set to Personal Reports Only, reports will be fixed to only include non-financial information for your own recorded time and expenses.

Automatic Removal of Users and Projects from Reports

If your Create Report Screen is being viewed in your reports (not administration) application, and you have projects or users assigned to your user account, your reports will only include those users and projects to which you have been granted permission to access (through your user account's user and project assignments).

The exception to this rule is in the creation of a manager's timesheet or expense claim spreadsheet report, which will display the full timesheets for all individuals noted as being in that manager's assigned scope of responsibility (for that timesheet output, it is assumed that a manager can view the projects against which their reporting employees will be recording time and expenses).

If no users or projects are assigned to an individual through their user account's assignment options, and that individual has been granted reports access, they will have access to all system user and project records in their reports.

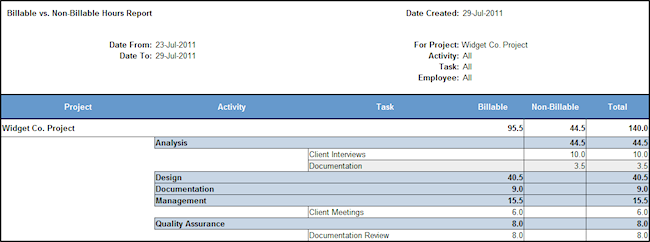

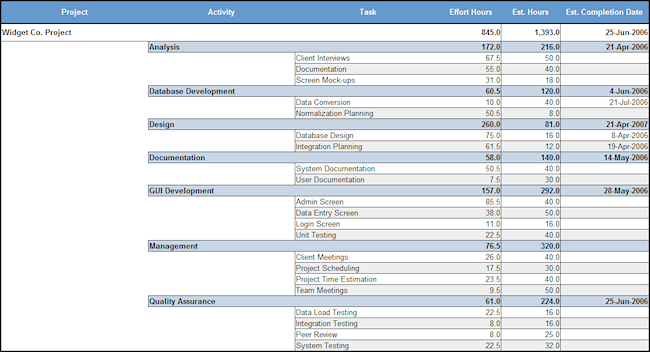

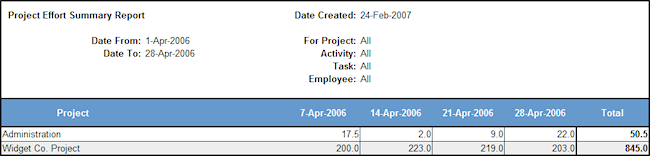

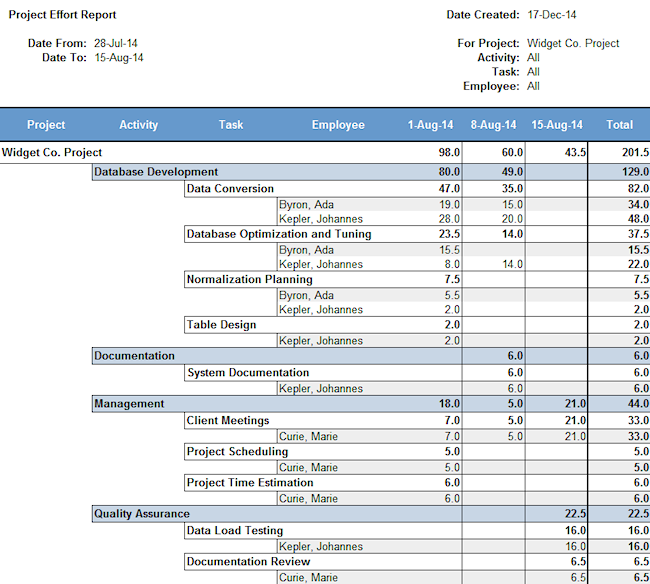

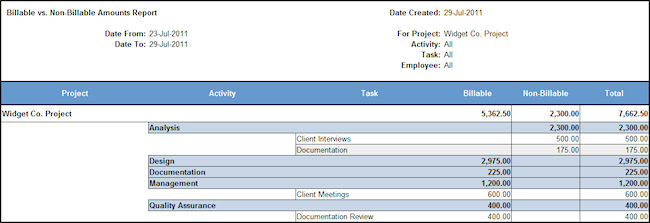

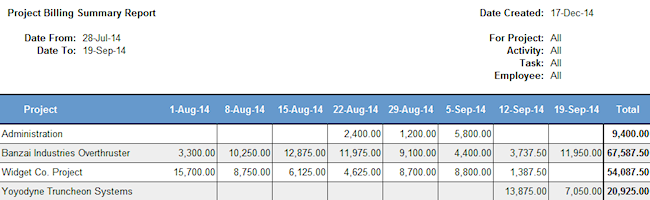

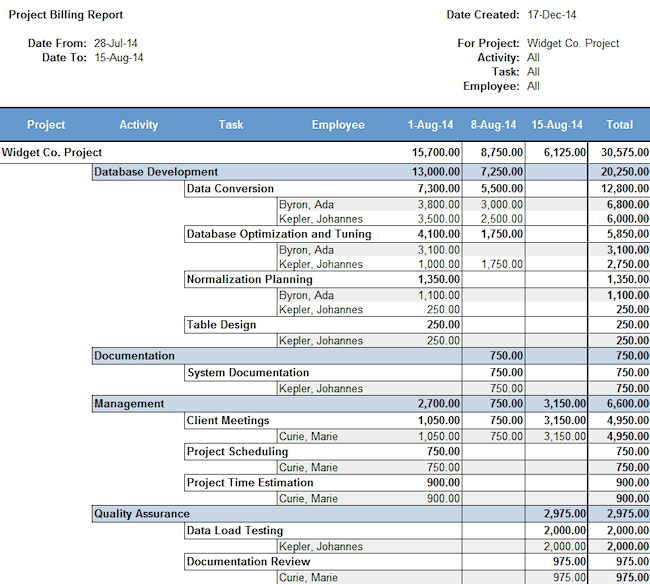

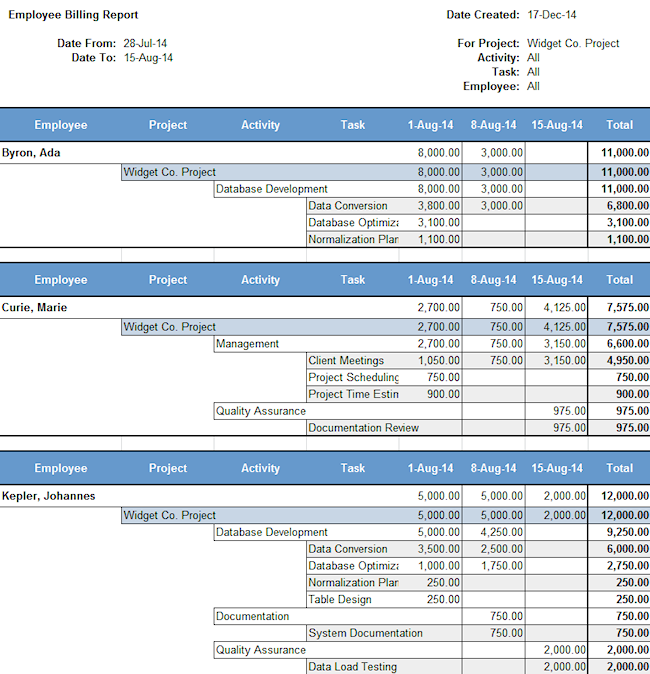

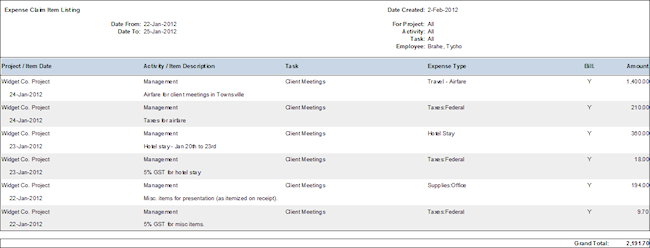

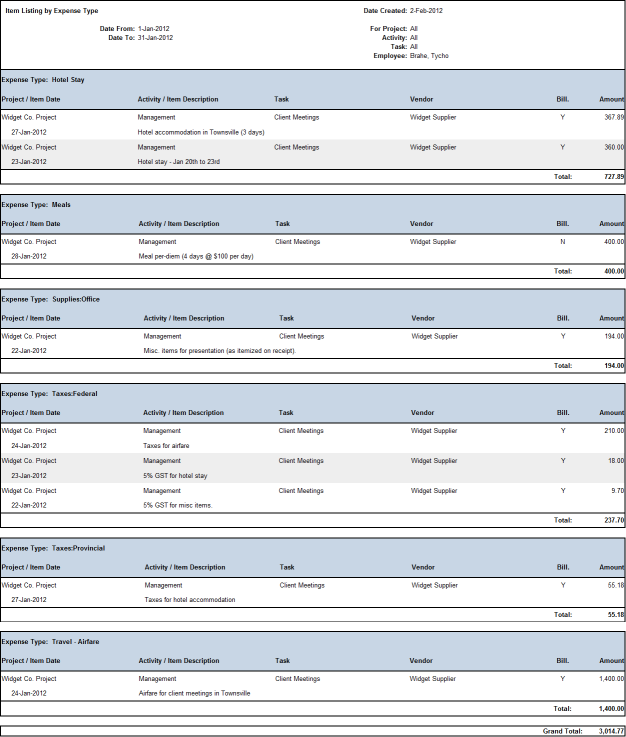

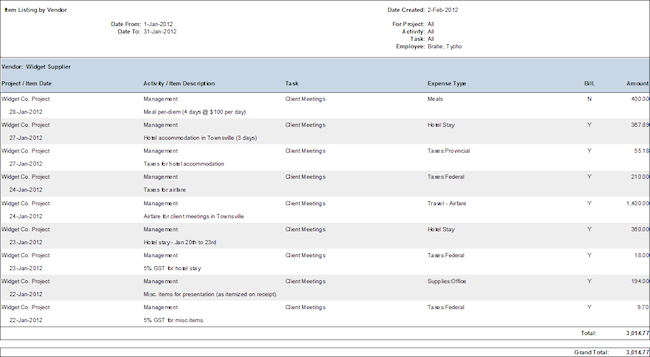

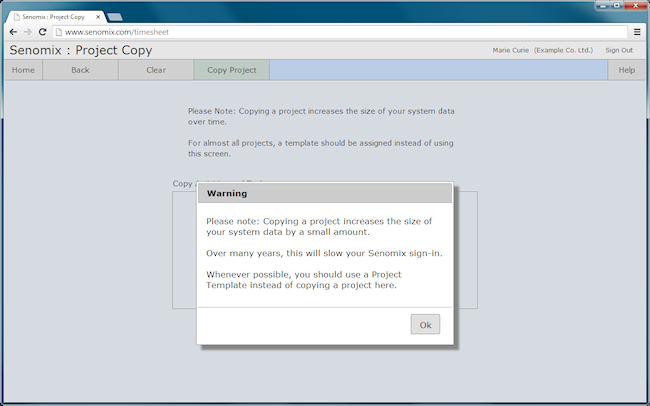

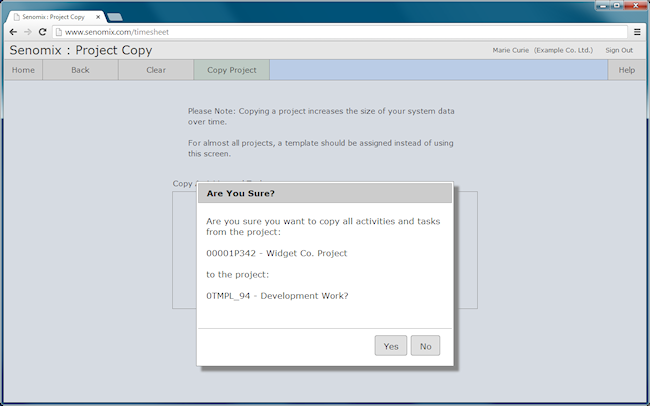

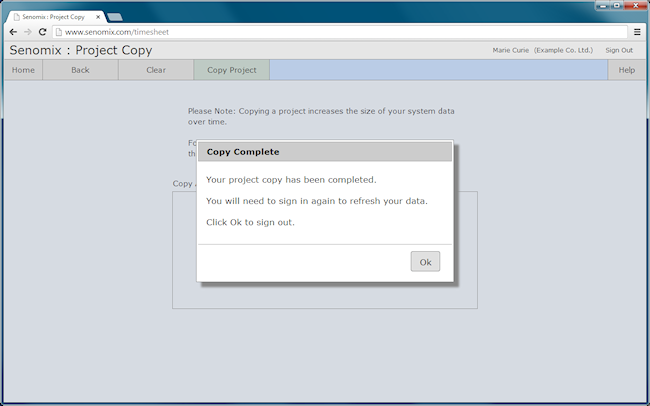

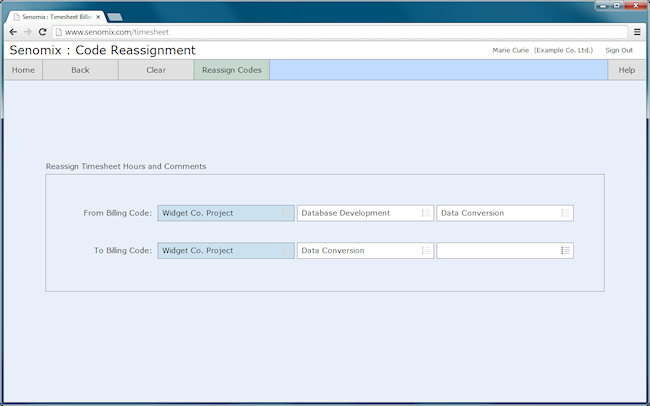

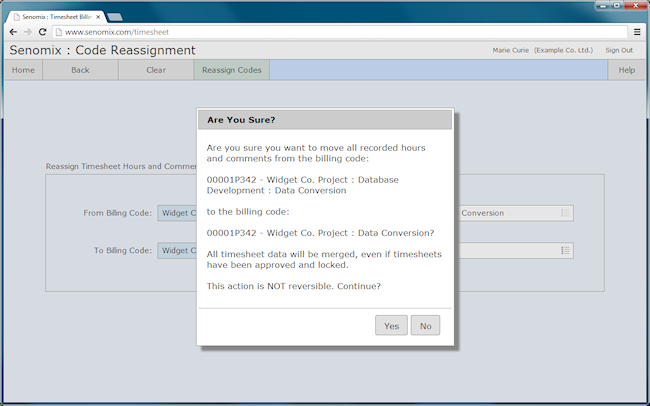

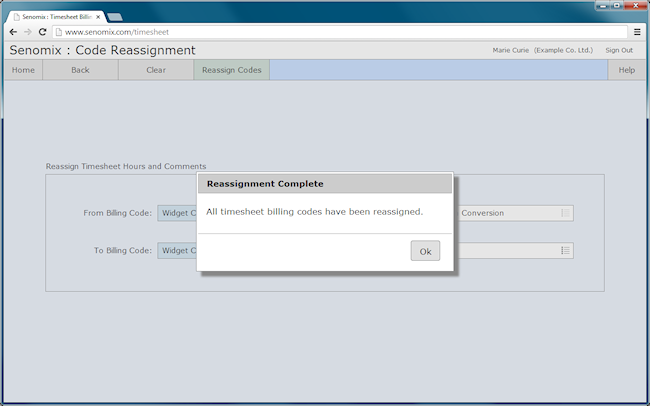

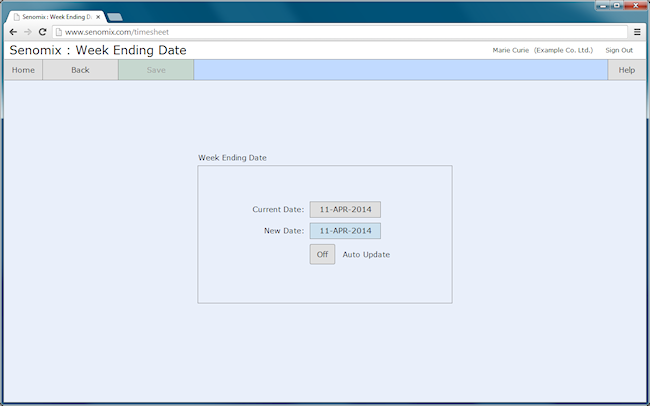

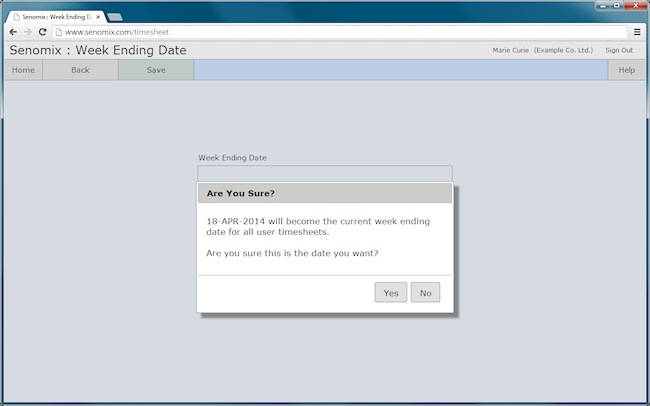

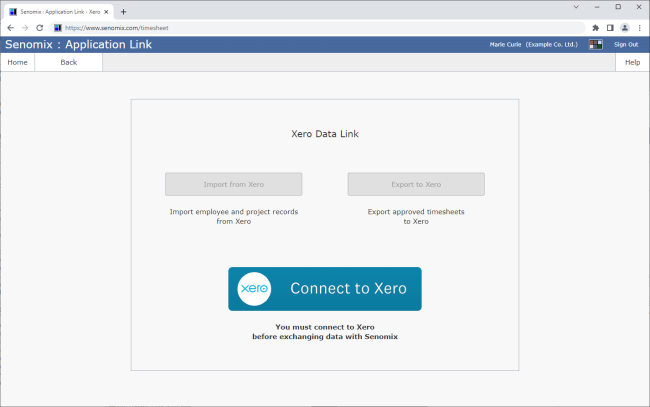

An employee with reports access rights will always be able to view their own timesheet data in their created reports.